Varun Beverages Share Price Target 2024, 2025, 2027 to 2040

Today in our blog we will explain the basic idea about Varun Beverages Share Price Target 2024, 2025, 2027, 2030, 2040. We did the research and took advice from experts to make this blog about company growth, the company’s performance, the future condition of the company, etc.

In this article, we will talk about Varun Beverages Share Price, what could be the future share price of Varun Beverages Share? VBL plays an important role in the Indian Beverages Company. Varun Beverages Ltd (VBL) is one of the Indian largest franchisees of PepsiCo not only in India but also outside of our country. The Share Price of Varun Beverages also growing day by day beside the company. In this article, we will discuss whether anyone should invest in Varun Beverages Share or not. From the current time to 2040 may it will be profitable or not? At the end of the article let us gain some knowledge about Varun Beverages Share Price Target 2024 to 2040.

What is Varun Beverages Ltd Company?

Varun Beverages Ltd Company’s main function is manufacturing, distributing, and selling a huge amount of carbonated soft drinks (CSDs) and noncarbonated beverages (NCBs) like packaged drinking water which is sold under PepsiCo. VBL was associated with Peosico in 1990.

Overview Of Varun Beverages (VBL) Ltd Company?

Varun Beverages (VBL) Ltd Company has the permission to supply various PepsiCo products across 27 States and 7 Union Territories in India and 5 other countries across the world. Varun Beverages Ltd Company also distributes soft drinks like Pepsi, Mountain Dew, Mirinda, Tropicana Slice fruit juice, Duke’s Club soda, and energy drinks apart from PepsiCo. The company also transports the franchise to the territories of Nepal, Morocco, and Zambia.

| Company Name | Varun Beverages Limited |

| Head Office | Gurgaon, Haryana |

| Book Value | ₹58 |

| Face Value | ₹5 |

| 52 Week High | ₹1680.69 |

| 52 Week Low | ₹785 |

| Book Value | ₹58 |

| DIV. YIELD | 0.16% |

| NSE SINE | VBL |

In the year 1956, New Delhi, Varun Beverages Ltd Company was incorporated as a public limited company under the Companies Act. The chairman of the company Mr. Ravi Jaipuria owns PepsiCo’s International Bottler of the Year award as an Indian. However the overall business progress is very good, the net profit of the company is very good, and the company has good market demand outside of the country also. For this reason, many good investors always be interested in investing the share. Varun Beverages Share Price was also low till in the year 2009 after that the share price also increased rapidly. In this article, we will discuss the company’s share.

Annual Performance Of Varun Beverages

Before investing any share anyone wants to see the company’s performance, overall profit, and net sales amount. We need a basic idea about the company’s PE ratio, return on assets, current ratio, and return on equity. In the below portion, we discuss the performance of the company.

PE Ratio (Price To Earning Ratio)

PE Ratio is calculated by Market price per share Earning price per share. It means the number of times investors are ready to pay as compared to earnings time. Varun Beverages Ltd Company has a PE ratio of 108.23, which is very high.

Return on Assets (ROA)

ROA is calculated by Profit After tax ÷ Total Assets. ROA is influenced by 2 factors, return on sales and asset turnover. Varun Beverages Ltd Company has a ROA of 14.23% which is high.

Current Ratio

The current Ratio is calculated by Current Assets ÷ Current Liabilities. Varun Beverages Ltd Company has a current ratio of 0.90.

Return On Equity (ROE)

ROE is measured by = Net profit ÷ Average Share holding equity. Varun Beverages Ltd Company has an ROE of 28.12%.

Varun Beverages Share Price Target 2024, 2025, 2027, 2030, 2040

Varun Beverages Ltd is a company that is listed on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). The company is the second-largest bottling company for Pepsico Beverages. Today in this article we will discuss the future in which direction the Vanus Beverages Share may run. If the company can progress in the beverages sector.

As the company is working for PepsiCo, so the product demand of PepsiCo depends upon the Varun Beverages Company. Soft drinks mostly PepsiCo products are huge not only in India but also in the United States. The company has 31 manufacturing units in India and also has 7 manufacturing units in different states. Varun Beverages Share Price was ₹136 in 2017 and now it became ₹1423.05 on 17th February, 2024. So there are huge changes in Share Price, hopefully, in the coming year, Varun Beverages Share Price Target also increase. Let’s have a look at Varun Beverages Share Price Target 2024 to 2040.

Also Read- Yatharth Hospital Share Price Target

Varun Beverages Share Price Target 2024

Varun Beverages Ltd is being benefited from an ever-increasing beverage company. As the company works with PepsiCo the demand for PepsiCo products is very high. Due to the reputation of a well-known brand, the demand also increases for a new generation of people.

| Year | Varun Beverages Share Price Target 2024 |

| 1st Price Target | 1550 |

| 2nd Price Target | 1610 |

For the increasing of sales rate, the company also decided to take new steps about launches of new products accordingly as per market demand of the product. Due to the new segmentation company is always able to supply the product according to different customer demands. Indian beverages sector increased its sales amount in the last 5 years. In the coming years, the sales amount will increase by 12% to 17% CAGR. The 1st Price Target of Varun Beverages Share Price Target is ₹1550 and the 2nd Price Target is ₹1610.

Varun Beverages Share Price Target 2025

Varun Beverages Ltd also spread its business in developing nations like Sri Lanka, Morocco, and Zambia in those countries company is earning more profit according to their currency. That reason the company also tried to spread its network across the international country. Thanking the matter the management of the company has decided to spread its business in global market, in a different city of different countries.

| Year | Varun Beverages Share Price Target 2025 |

| 1st Price Target | 1730 |

| 2nd Price Target | 1850 |

With the increasing export demand, the management of the company focuses on production quality. PepsiCo is famous for its production quality from the very early stage of the company. At present due to huge selling pressure, it may happen the production quality may be decreased. To prevent that matter Varun Beverages Ltd Company uses modern technology and developed equipment for more production and carries out the same production quality. According to the analysis of doing market analysis, the 1st Price Target of Varun Beverages Share Price is ₹1730 and the 2nd Price Target is ₹1850.

Also Read- Globe Textiles Share Price Target

Varun Beverages Share Price Target 2027

For the reason of exporting products to different countries, the investment percentage of foreign investors in Varun Beverages Share is very high which is 25.69% which is a very positive sign in companies growth. The market holding capacity of the companies is very high which is 62.25% for this reason many good investors always want to invest in the share.

| Year | Varun Beverages Share Price Target 2027 |

| 1st Price Target | 2160 |

| 2nd Price Target | 2220 |

For good market holding capacity company will never lose its market. The sales amount of the company is always high position, which is 29.29% in the last 5 years. In the last financial year 2024, the sales amount is ₹3,556.12 Crore. If we look at the share price of Varun Beverages Share it also rapidly increases. The 1st Price Target of Varun Beverages Share Price for the year 2027 is ₹2160 and the 2nd Price Target is ₹2220.

Varun Beverages Share Price Target 2030

In developing countries like India, the use of soft drinks may be expanded due to lifestyle changes the consumption of soft drinks may expand shortly. Till now in developing countries, the consumption of soft drinks has not very range but the Varun Beverages Ltd Company has a huge scope to expand in the future on a long-term basis.

| Year | Varun Beverages Share Price Target 2030 |

| 1st Price Target | 3090 |

| 2nd Price Target | 4020 |

Varun Beverages Ltd Company has had strong profit growth which is 71% in the last 5 years and the share also has the strong potential to expand the share price target in the future. Till Varun Beverages is attached to the food and beverages sector the demand will never decrease and has a chance to increase. The 1st Share Price Target for the year 2030 of Varun Beverages Share Price is ₹3090 and the 2nd Price Target is ₹4020.

Varun Beverages Share Price Target 2040

Varun Beverages Ltd Company is now mostly focused on the advertisement of their product. Advertisement is the best option to reach the product in different corners of the country. In this way, the company wants to increase the net sales amount of the company. The process of earning more profit is well known by the company’s management team.

| Year | Varun Beverages Share Price Target 2040 |

| 1st Price Target | 10,010 |

| 2nd Price Target | 11,000 |

The prediction of the share price depends upon whether the company will be able to maintain the continued company performance, if the profit growth, the net sales amount, and the quality of the product will be maintained by the company then the prediction of the company’s share will vary in that range. The share has to potential to give a good return to the investors. The 1st Price Target of Varun Beverages Share Price is ₹10,010 and the 2nd Price Target is ₹11000.

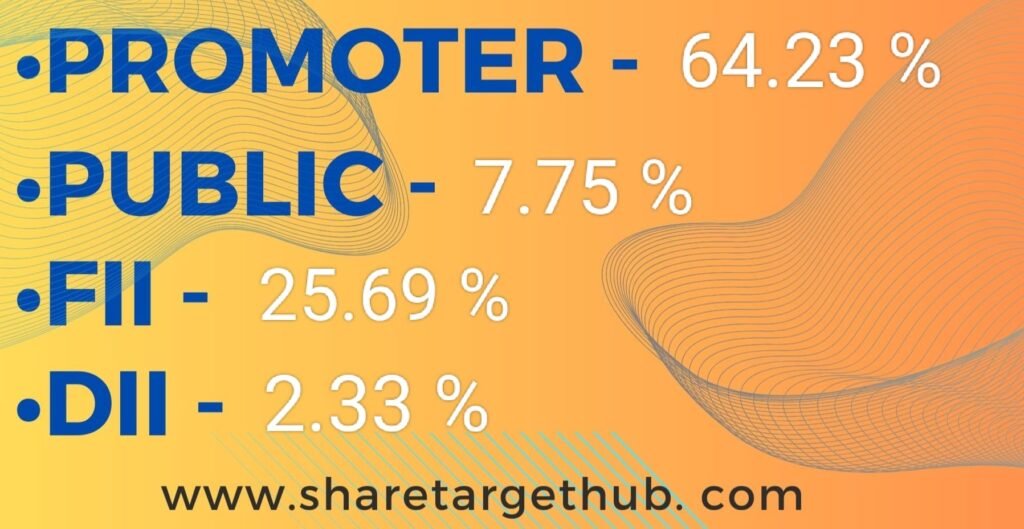

Investors types and ratios Of Varun Beverages Share

There are mainly four main types of Investors in Varun Beverages Share.

Promoters Holding (64.23%)

Promoters Holding means how much capital is invested by company promoters (owner of the company) through overall capital. For Varun Beverages Share promoter holding capacity is 64.23%.

Public Holding (7.75%)

Public Investors an individuals who invest in the public market for profit in the future (large and small companies). For Varun Beverages Share, the Public Holding capacity is 7.75%.

FII (Foreign Institutional Investors) 25.69%

Foreign Institutional Investors are those big companies that invest in different countries company. The FII amount of Varun Beverages Share is 25.69%.

DII (Domestic Institutional Investors) 2.33%

Domestic Institutional Investors (like Insurance, companies mutual funds) who invest in their own country. The DII amount of Varun Beverages Share is 2.33%.

Advantages and Disadvantages Of Varun Beverages Share

Every share has some advantages and disadvantages Varun Beverages Share also has some advantages and some disadvantages which are described below.

Advantages

- In the last 5 years, the net profit amount of the company is 71% which is a positive sign for the company’s growth which helps the increase of the share price target of the company.

- In the past 3 years, the revenue growth of the company is 22.23% which is also a positive side for the company’s growth.

- The cash flow ratio of the company is very high, the cash conversion cycle is 10.68 days which is good for the company’s growth.

Disadvantages

- In the last 2 years, the book value amount of the company has decreased which may negatively affect in company’s growth.

- Varun Beverages Ltd Company is related to the beverage sector there are many competitor companies there may be some difficulties in continuing the net profit amount of the company.

Also Read– Suzlon Energy Ltd (SUZLON) Share Price Target

FAQ

What is the Varun Beverages Share Price Target for the year 2024?

Varun Beverages Share Price Target for the year 2024 is ₹1550 to ₹1610.

What is the Varun Beverages Share Price Target for the year 2025?

Varun Beverages Share Price Target for the year 2025 is ₹1730 to ₹1850.

What is the Varun Beverages Share Price Target for the year 2027?

Varun Beverages Share Price Target for the year 2027 is ₹2160 to ₹2220.

What is the Varun Beverages Share Price Target for the year 2030?

Varun Beverages Share Price Target for the year 2030 is ₹3090 to ₹4020.

What is the Varun Beverages Share Price Target for the year 2040?

Varun Beverages Share Price Target for the year 2040 is ₹10,010 to ₹11,000.

Is Varun Beverages Share good to buy?

Yes, Varun Beverages Share is very good for future growth. With the Profit growth of the company the share also increases rapidly, the profit growth is 71%. The share also increases very high range. If anyone wants to invest in Varun Beverages Share in the future it give a good return to investors.

Who is the CEO of Varun Beverages Ltd Company?

Mr. Kapil Agarwal is the CEO of Varun Beverages Company.

Conclusion

Hopefully, www.sharetargethub.com will help you gain some basic ideas about the Varun Beverages Share Price Target. By doing the research and taking advice from the experts we ensure that on a long-term basis, Varun Beverages Share Price Target may reach a very high position. As Varun Beverages Share is related to the food and beverages sector, So the demand for this sector also increases which helps the share to gain profit in the future.

If you think this website will be helpful for you then you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.