Oil India Share Price Target 2024, 2025, 2027 And 2030. Look At The Highest Share Price Target

Today in our blog we will explain the basic idea about Oil India Share Price Target 2024, 2025, 2027, 2030. We did the research and took advice from experts to make this blog about the company’s growth, the company’s performance, etc.

Oil India Share Price Target is a trading share in the share market. If you are thinking about which is best for investment in recent times then you should know about Oil India Share Price Target. In this article, we will discuss about company’s financial growth, the business policy of the company, the shareholding pattern of the company, and the forecast share price yearly basis. We use data and analysis from experts to give a clear knowledge about Oil India Share Price Target. This article may be helpful to those who want to invest in this share right now. Let’s have a look at Oil India Share Price Target 2024 to 2030.

What Is Oil India Ltd Company?

The main business of Oil India Limited company is the exploration, development, and production of crude oil and natural gas. The company deals with the transportation of Crude Oil and the production of liquid petroleum gas. It is a central public sector.

Overview Of Oil India (OIL) Ltd Company

The headquarters of the company is situated in Duliajan, Noida, Guwahati. The company was established in the year 1959. Oil India is the second-largest national oil and gas extraction company in India. Oil India Company is a state-owned company under the administrative control of the Ministry Of Petroleum and Natural Gas. Oil India Company has owned the Status of “Maharatna” from the State Government Oil Department.

| Company Name | Oil India Limited Company |

| Established | 1959, 18th February |

| Market Cap | ₹1,01,123.43 Crore |

| Face Value | ₹10 |

| Book Value | ₹275.23 |

| P/B | 2.26 |

| DIV. YIELD | 2.55% |

| 52 Week High | ₹653.12 |

| 52 Week Low | ₹169.10 |

| NSE Sine | OIL |

Oil India Ltd Company plays an important role in developing and growing the petroleum industry in India. In recent times Oil India company had a trunk pipelines network with a capacity of 9.67 MMTPA in an area of 1235 Km is used for the transportation of crude oil produced by OIL and ONGCL in the Northeast region. The 660 Km pipeline segment between Bongaigaon and Barauni was reconstructed for oil transmission.

In the year 2008-09, Oil India reconstructed a 656 Km pipeline in the area of Numaligarh to Siliguri which has the capability of 1.89 MMTPA. In the year 1889 first time oil was discovered in India and the Oil India company was established in 1959 from that time till now the company was rapidly growing in the newly launched Oil field.

Financial Data Analysis Of Oil India Ltd Company

Before investing any share anyone wants to see the company’s performance, overall profit, and net sales amount. We need a basic idea about the company’s PE ratio, return on assets, current ratio, and return on equity. In the below portion, we discuss the performance of the company. Oil India Share Price Target also depended upon the ratio which is described below.

PE Ratio (Price To Earning Ratio)

PE Ratio is calculated by Market price per share Earning price per share. It means the number of times an investor is ready to pay as compared to earnings time. Oil India Company has a PE ratio of 18.00, which is low.

Return on Assets (ROA)

ROA is calculated by Profit After tax ÷ Total Assets. ROA is influenced by 2 factors return on sales and asset turnover. Oil India Company has a ROA of 12.74%, which is a bad sign for the company’s growth.

Current Ratio

The current Ratio is calculated by Current Assets ÷ Current Liabilities. Oil India Company has a current ratio of 1.90.

Return On Equity (ROE)

ROE is measured by = Net profit ÷ Average Share holding equity. Oil India Company has a ROE of 22.12%, which is high.

Also Read- Shyam Metalics Share Price Target

Oil India Share Price Target 2024, 2025, 2027, 2030

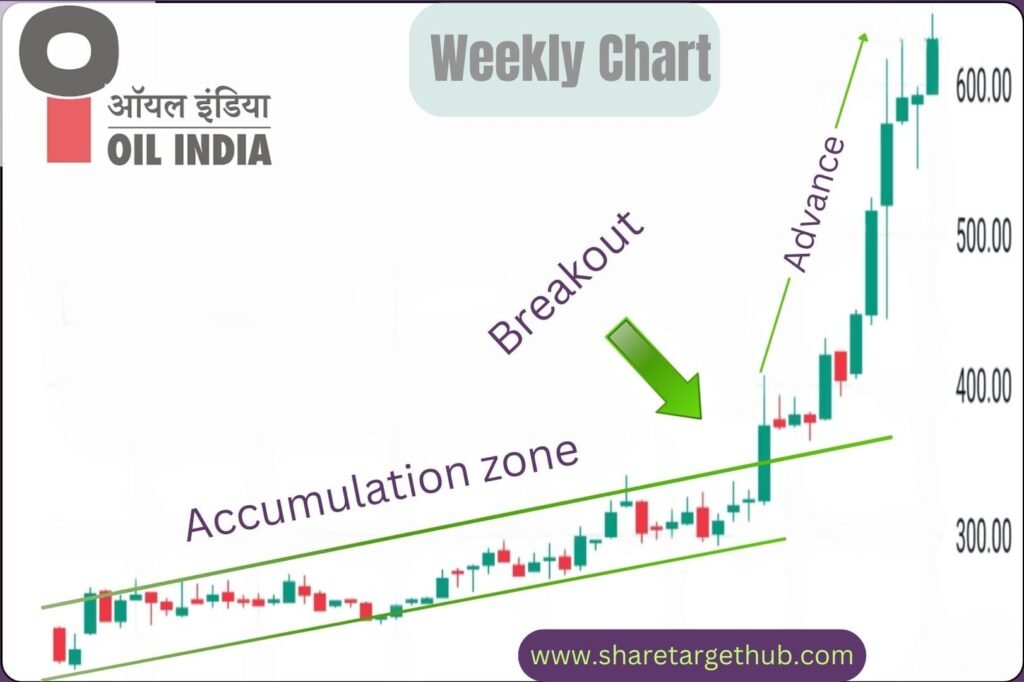

Oil India Share Price Target is a bullish trend in the share market. The stock is enlisted under the BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). Last 6 months the share price growth was +330.37 (124.98%), the last 1-year share price growth was +424.23 (248.86%), last month’s share growth was +142.80 (31.60%) and the maximum share growth was +439.19 (282.42%).

As an oil and gas extraction sector, Oil India Company will grow more in the future and the demand of the company is the topmost position in recent times. Oil India Share Price Target always runs to good profit and Oil India Share always gives good returns to investors.

In the last 1 week, the share price has been growing slowly but in the coming future, Oil India Share Price growth rate will increase like the previous year. If anyone wants to invest in the share on a long-term basis it will be beneficial.

Oil India Share Price Target 2024

Now most of the country’s government gives the most important about the uses of renewable energy sources. Oil India Ltd company started the project to produce electricity from solar plants which have a capacity of 0.892 MW and other solar plants of 0.026 MW, 0.05 MW, 0.037 MW, and 0.0008 MW which are situated in different cities in India.

The company also works for the generation of electricity from the power of the wind. The last wind power energy was established by the company in the financial year 2016-17 in Gujarat capacity of 28.2 MW, also in Madhya Pradesh capacity of 26.3 MW. Oil India also generates good revenue from green energy ₹122.63 Crore in the last financial year 2022-23. The promoter holding capacity of the company is 57% which is very good for the company’s growth.

| Year | Oil India Share Price Target 2024 |

| 1st Price Target | 630 |

| 2nd Price Target | 840 |

As an oil and gas extraction company, the sales rate of the company increases. Last 3 years sales rate was 21% and last year’s sales rate was 48%. The net sales amount was ₹15,542.23 Crore in the financial year March 2022 which became ₹22,425.82 Crore in March 2023. If we look at the forecast share price target Oil India Share Price Target 2024 the 1st Price Target is ₹630 and the 2nd Price Target is ₹840.

Oil India Share Price Target 2025

Oil India Company is attached to the production of LPG Gas. The company 1st established an LPG Plant in ASSAM in the year 1982 with a production capability of 2.56 MMSCMD. In this LPG Plant, the company used Turbo Expander Technology for the 1st time. The LPG recovery plant has experienced more than 40 years. From the plant after production sends it to the LPG filling Plant to fill cylinders and road tankers. Oil India also has a demand for the production of natural gas. In 2011 the company started to supply natural gas to Numaligarh Refinery Limited (NRL).

| Year | Oil India Share Price Target 2025 |

| 1st Price Target | 1005 |

| 2nd Price Target | 1125 |

The profit growth of the company also increases. In the last 3 years, profit growth was 39% which increased up to 76% in the last year. The profit amount was ₹3878.12 Crore in the year 2022, March which became ₹6814.12 Crore in March 2023. If we look at the share price forecast Oil India Share Price Target 2025, the 1st Price Target is ₹1005 and the 2nd Price Target is ₹1125.

Also Read- Vibhor Steel Tubes Share Price Target

Oil India Share Price Target 2027

In recent times Oil India Share may started to fall for crude oil. In the December quarter, the prices of crude oil fell 6.5%. The total revenue which is gained by crude oil to the Oil India company also increased by 5.8% and the revenue from natural gas also fell by 14.2% in the current month.

| Year | Oil India Share Price Target 2027 |

| 1st Price Target | 1425 |

| 2nd Price Target | 1663 |

Oil India has two R&D centers. The Ministry Of Science & Technology, Government of India recognizes both of the centers. Experienced R&D teams always try to improve modern technology and equipment in the drilling field, oil recovery system, production, transportation, petrochemical product extraction, etc. The R&D team always tries to improve the company and more exploration of business. If we look at the share price target forecast Oil India Share Price Target 2027 1st Price Target is ₹1425 and the 2nd Price Target is ₹1663.

Oil India Share Price Target 2030

To develop oil & gas Oil India company uses cluster well drilling for the build-up protection of green belts around the company’s operational area. The company has 11 drilling rings and 11 work-over rings. The Well Logging Department won the 1ST prize in the North Eastern Oil Mines Safety Competition for the best safety provider for employees.

| Year | Oil India Share Price Target 2030 |

| 1st Price Target | 2225 |

| 2nd Price Target | 2325 |

In the last 3 years, the company’s annual revenue growth is 37.12% CAGR of 19.12%. The return amount from the Oil India share price is in the 3 years 94% and the last month’s 20.01%. The company also deals with foreign countries for that reason many foreign investors want to invest in the share. The FII investors amount is 11-12% which is a very positive sign for the company’s growth.

All the share price forecasts depend upon the company’s overall growth and favorable market conditions. As Crude Oil transportation and the production of liquid petroleum gas, the company will grow more in the future. Oil India Share Price Target also will increase rapidly in the future. If we look at the forecast share Price target, Oil India Share Price Target 2030 the 1st Price Target is ₹2225 and the 2nd Price Target is ₹2325.

How To Purchase Oil India Share?

The most common trading platform for purchasing the Oil India Share is described below.

- Zerodha

- Upstox

- Groww

- Angelone

Peer’s Company of Oil India

- Jindal Drilling

- Asian Energy

- Deep Ind

- Gujarat Natural

- HOEC

Investors types and ratio of Oil India Company

There are mainly four Types of Investors in Oil India Ltd Company. The company’s growth also depended upon the ratio of investors who invested in the share.

Promoters Holding

Promoters Holding means how much capital is invested by company promoters (owner of the company) through overall capital. Oil India Company’s promoter holding capacity is 57.09%.

Public Holding

Public Investors an individuals who invest in the public market for profit in the future (large and small companies). For Oil India Company’s public Holding capacity is 7.01%.

FII (Foreign Institutional Investors)

Foreign Institutional Investors are those big companies that invest in different countries company. For Oil India Company’s FII is 11.01%.

DII (Domestic Institutional Investors)

Domestic Institutional Investors (like Insurance, companies mutual funds) who invest in their own country. For Oil India Company’s DII is 24.89%.

Advantages and Disadvantages Of Oil India Share

Every share has some advantages and some disadvantages also. So, the Oil India Share Price Target also has some advantages and disadvantages which are described below.

Advantages

- The Profit growth of the company is 39% in the last 3 years.

- The revenue growth of the company is also 37.12% in the last 3 years which is a very positive sign of the company’s growth.

- The company is growing with low debt and the interest cover ratio of the company is 14.12 which means the company easily recovers all debt.

- The company has an effective cash conversation cycle which is -984.45 days which is a very good sign for the company’s growth.

- The operating margin is 31.12% in the last 5 years which is very effective for the company’s growth.

Disadvantages

The company’s TTM Net Profit is majorly falling.

Also Read- MRPL Share Price Target

FAQ

What is the Oil India Share Price Target for the year 2024?

Oil India Share Price Target for the year 2024 is ₹630 to ₹840.

What is the Oil India Share Price Target for the year 2025?

Oil India Share Price Target for the year 2025 is ₹1005 to ₹1125.

What is the Oil India Share Price Target for the year 2026?

Oil India Share Price Target for the year 2026 is ₹1260 to ₹1330.

What is the Oil India Share Price Target for the year 2027?

Oil India Share Price Target for the year 2027 is ₹1425 to ₹1663.

What is the Oil India Share Price Target for the year 2028?

Oil India Share Price Target for the year 2028 is ₹1725 to ₹1865.

What is the Oil India Share Price Target for the year 2030?

Oil India Share Price Target for the year 2030 is ₹2225 to ₹2325.

Is Oil India Share good to buy?

Oil India Share Price Target increased in the last 6 months by 124.2%, and in the last month’s share growth was 35.55%. Last year’s profit growth was 76%. With the company’s growth Oil India Share Price Target will be increased. If anyone wants to invest it will be beneficial in the long-term process.

What is the future of Oil India Company?

The future of Oil India Company is on its way to brightly increase. Within the last 3 years, the profit growth of the company has increased from 39% to 76%. Many foreign investors also invest which is 11.01% and the promoter holding capacity of the company is 57%. The R&D team of the company always innovates new technology and equipment for the company’s growth. In the future, the company will grow more.

Who is the CEO of Oil India Company?

Mr. Ranjit Rath is the CEO of Oil India Company.

Conclusion

Hopefully, www.sharetargethub.com will help you gain some basic ideas about the Oil India Share Price Target. By doing the research and taking advice from expertise we ensure that on a long-term basis, Oil India Share Price Target may reach a very high position. Oil India Company is related to Crude Oil transportation and the production of liquid petroleum gas. So the demand for this sector also increases which helps the share to gain profit in the future.

If you think this website will be helpful for you then you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.