IRCTC Share Price Target 2024, 2025, 2027, 2030, 2040

If you think about which share will be best for investment in recent times then you should know about IRCTC Share Price Target. Today in our blog we will explain the basic idea about the IRCTC Share Price Target 2024, 2025, 2027, 2030, 2040. We did the research and took advice from experts to make this blog about the company’s growth, performance, etc.

IRCTC Share Price Target is a trading share in the share market. In this article, we will discuss the company’s financial growth, the business policy of the company, the shareholding pattern of the company, and the forecast share price yearly. We use expert data and analysis to understand the IRCTC Share Price Target. This article may be helpful to those who want to invest in this share right now. Let’s look at the IRCTC Share Price Target 2024 to 2040.

What Is the IRCTC Company?

The full form of IRCTC is the Indian Railway Catering and Tourism Corporation which provides ticketing, catering, and tourism services for the Indian Railway. The company is an Indian Public Sector under the Ministry Of Railways. The company was established in the year 1999.

Overview Of IRCTC Company

The Daily average booked ticket number by the company is 7.31 lakh. As of December 2023, the registered user’s number with the IRCTC is 66 million. In the year May 2008, the company was owned by Miniratna Status. IRCTC Company first started an online ticketing system in the year 2002. The company provides different channels to customers for booking tickets like website, SMS, different apps, etc.

| Company Name | IRCTC Company |

| Market Cap | ₹79,250 Crore |

| Book Value | ₹41.25 |

| Face Value | ₹2 |

| 52 Week High | ₹1,256.85 |

| 52 Week Low | ₹614.45 |

| P/B | 25.21 |

| DIV. YIELD | 0.67% |

Financial Data Analysis Of IRCTC Company

Before investing any share anyone wants to see the company’s performance, overall profit, and net sales amount. We need a basic idea about the company’s PE ratio, return on assets, current ratio, and return on equity. In the below portion, we discuss the performance of the company. IRCTC Share Price Target also depended upon the ratio which is described below.

| PE Ratio | Return On Assets (ROA) | Current Ratio | Return On Equity (ROE) |

| 71.25 | 23.12% | 1.85 | 47.15% |

History Of IRCTC Share Price Target 2024 to 2040

IRCTC Share is a bullish trend in the share market. IRCTC Share is under both stock Exchanges BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). The last 6 month’s share growth was +216.70 (28.43%), the last 1 year’s share growth was +338.65 (52.90%), the last 5 years +822.97 (528.12%), and the maximum share growth was +822.97 (258.12%).

IRCTC Share price return amount was 4.35% in the last 3 months, the last 1 year’s share return percentage was 50.48%, and the last 3 year’s share was 134.85%. IRCTC Share always gives a good return to investors. If anyone wants to invest in the share it will be profitable on a long-term basis. Let’s have a look at IRCTC Share Price Target from 2024 to 2040.

Also Read – IRCON Share Price Target

IRCTC Share Price Target 2024

The main operating fields in which the IRCTC Company operates are Internet Ticketing, Tourism, Catering, and Rail Neer. In the Internet Ticketing facility, the company provides an online train ticket booking facility through the IRCTC website and Mobile App. In the Tourism segment, the company provides tourism-related products such as train tours, hotels, airline ticketing, holiday products, etc.

| Year | IRCTC Share Price Target 2024 |

| 1st Price Target | 923.85 |

| 2nd Price Target | 1,145.74 |

The revenue amount was ₹3,745.85 Crore in March 2023 which increased to ₹4,589.85 Crore in March 2024. The total operating revenue amount was ₹3,645.85 Crore in March 2023 which increased to ₹4,385.78 Crore in March 2024. If we look at the IRCTC Share Price Target 2024 forecast, the 1st Price Target is ₹923.85, and the 2nd Price Target is ₹1,145.74.

IRCTC Share Price Target 2025

The Catering Segment is the Catering System in trains which is linked to food plazas, retiring rooms, e-catering units, fast food units budget hotels, etc. In the Rail Neer segment, the company provides a production and distribution facility of bottled water and the construction of Rail Neer plants. The Internet ticketing and tourism segment contributes 38% of the overall revenue and earns 84% of the overall gross profit.

| Year | IRCTC Share Price Target 2025 |

| 1st Price Target | 1,258.45 |

| 2nd Price Target | 1,445.36 |

The profit growth of the company is very good. The last 5 years profit growth was 36.25% which decreased to 26.85% in the last 3 years which increased to 53.14% in the last 1 year. The net profit growth was ₹660.25 Crore in March 2022 which increased to ₹1,125.74 Crore in March 2023. If we look at the IRCTC Share Price Target 2025 forecast, the 1st Price Target is ₹1,258.45, and the 2nd Price Target is ₹1,445.36.

IRCTC Share Price Target 2027

The Internet Ticketing segment of IRCTC Company the company provides information to millions of users. It has more than 4 Crore users and daily login passenger users of more than 40 lakh. The company hosts 6 lakh visitors on its booking confirmation page per day which is a great opportunity for the company to create more revenue through online business. In the year 2020, the booking percentage was 72% which increased to 75% in the year 2021.

| Year | IRCTC Share Price Target 2027 |

| 1st Price Target | 1,874.69 |

| 2nd Price Target | 2,012.45 |

The Sales percentage of the company was 20.25% in the last 5 years which decreased to 16.74% in the last 3 years and in the last 1 year, it increased to 89.12%. The net sales amount was ₹966.45 Crore in March 2023 which increased to ₹1,256.45 Crore in March 2024. If we look at the IRCTC Share Price Target 2027 forecast, the 1st Price Target is ₹1,874.69, and the 2nd Price Target is ₹2,012.45.

Also Read – RVNL Share Price Target

IRCTC Share Price Target 2030

Indian Railway Provides many special trains and semi-luxury trains which are operated by IRCTC Company like the luxury train Maharaja Express is operated by IRCTC company. Many election special trains are also operated by IRCTC Company. From luxury trains the company’s earning revenue amount was ₹41.57 Crore, from election special trains earning revenue was ₹41.52 Crore, from state special trains earning revenue was ₹265.78 Crore, from hotels and packages the earning revenue was ₹14.2 Crore all amount are in the year 2016-17.

| Year | IRCTC Share Price Target 2030 |

| 1st Price Target | 2,623.41 |

| 2nd Price Target | 2,874.96 |

The ROE percentage of the company was 34.26% in the last 5 years which decreased to 33.45% in the last 3year’s and in the last 1 year, it increased to 53.12%. The ROCE percentage of the company was 50.12% in the last 5 years which decreased to 45.85% in the last 3 years and in the last 1 year, it increased to 47.89%. If we look at the IRCTC Share Price Target 2030 forecast, the 1st Price Target is ₹2,623.41, and the 2nd Price Target is ₹2,874.96.

IRCTC Share Price Target 2040

The E-Catering services of IRCTC company cover 300 stations with branded food services company like Domino’s, KFC, McDonald’s, etc which provides more than 7000 meals daily. The Budget Hotel plan of IRCTC Company is an important part of the four properties in New Delhi, Puri, Howrah, and Ranchi. Packaged drinking water is one of the growing parts of IRCTC Company. The non-current asset amount was ₹31.2 Crore in the year 2020 which increased to ₹283.5 Crore in the year 2021.

| Year | IRCTC Share Price Target 2040 |

| 1st Price Target | 5,589.74 |

| 2nd Price Target | 5,774.36 |

As the company is a very old company the promoter holding capacity of the company is very good which is 63.12% which means many good investor wants to invest in the share. The total expenditure amount was ₹641.52 Crore in March 2023 which increased to ₹793.56 Crore in March 2024. If we look at the IRCTC Share Price Target 2040 forecast, the 1st Price Target is ₹5,589.74, and the 2nd Price Target is ₹5,774.36.

How To Purchase IRCTC Share?

The most common trading platform for purchasing the IRCTC Share is described below.

- Zerodha

- Upstox

- Groww

- Angelone

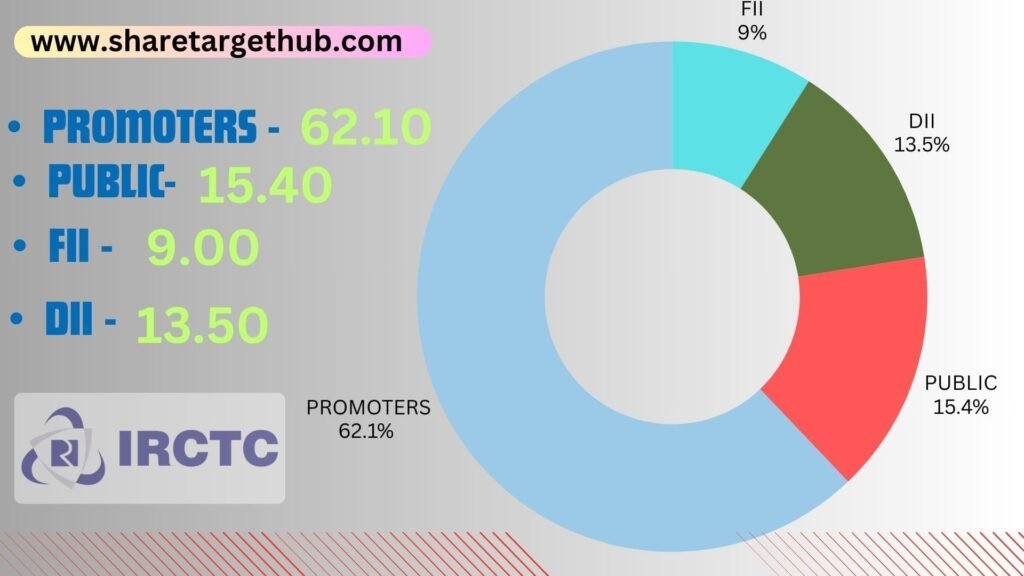

Investors Types And Ratio Of IRCTC Limited

There are mainly Four main Types of Investors in IRCTC Limited. The company’s growth also depended upon the ratio of investors who invested in the share.

Promoters Holding

Promoters Holding means how much capital is invested by company promoters (company owner) through overall capital. IRCTC Limited Company’s promoter holding capacity is 62.10%.

Public Holding

Public Investors are individuals who invest in the public market profit in the future (large and small companies). IRCTC Limited Company’s public holding capacity is 15.40%.

FII

Foreign Institutional Investors are those big companies that invest in different countries company. IRCTC Limited Company’s FII is 9.00%.

DII

Domestic Institutional Investors (like Insurance, companies, and mutual funds) who invest in their own country. IRCTC Limited Company’s DII is 13.50%.

Advantages and Disadvantages Of IRCTC Share

Every share has some advantages and some disadvantages also. So, the IRCTC Share Price Target also has some advantages and disadvantages described below.

Advantages

- The profit growth of the company in the last 3 years is very good which is 53.14%.

- The company has shown a good revenue growth which is 17.82% in the last 3 years.

- The promoter holding capacity of the company is good which is 63.12%.

- The company has a healthy ROE ratio which is 53.12% in the last 3 years.

- The ROCE percentage of the company is very good which is 45.85% in the last 3 years.

- The company has a small amount of debt and the interest cover ratio of the company is good which is 85.13.

- The cash conversation cycle of the company is good which is -1,385.89 days.

Disadvantages

- The PE ratio of the company is very high which is 71.25.

- The company has a high EBITDA which is 47.25.

Also Read – IRFC Share Price Target

FAQ

Is IRCTC a government-owned company?

IRCTC is a government-owned company that was established in the year 1999.

Should I invest in IRCTC Share right now?

The last 6 months’ share growth was 28.43%, and the last 1 year’s share price return amount was 50.48%. The company has an interest cover ratio and the ROCE percentage of the company is very good which is 45.85%. If anyone wants to invest in the share it will grow more in the coming future.

What is the future growth of IRCTC Company?

The last 3 year’s profit growth of the company was 53.14%, and the last 3 year’s revenue growth was 17.82%. As a very old company, it has a good promoter holding capacity which is 63.12%. The ROE percentage of the company is good which is 53.12%. Which will grow more in the coming future.

What is the IRCTC Share Price Target for 2024?

IRCTC Share Price Target for 2024 is ₹923.85 to ₹1,145.74.

What is the IRCTC Share Price Target for 2025?

IRCTC Share Price Target for 2025 is ₹1,258.45 to ₹1,445.36.

What is the IRCTC Share Price Target for 2027?

IRCTC Share Price Target for 2027 is ₹1,874.69 to ₹2,012.45.

What is the IRCTC Share Price Target for 2028?

IRCTC Share Price Target for 2028 is ₹2,145.65 to ₹2,396.74.

What is the IRCTC Share Price Target for 2030?

IRCTC Share Price Target for 2030 is ₹2,623.41 to ₹2,874.96.

What is the IRCTC Share Price Target for 2040?

IRCTC Share Price Target for 2040 is ₹5,589.74 to ₹5,774.36.

Conclusion

Hopefully, www.sharetargethub.com will help you gain some basic ideas about the IRCTC Share Price Target. By doing the research and taking advice from expertise we ensure that on a long-term basis, IRCTC Share Price Target may reach a very high position. IRCTC Company is related to the provides ticketing, catering, and tourism services for the Indian Railway sectors. So the demand for this sector also increases which helps the share to gain profit in the future.

If you think this website will be helpful for you then you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.