Apollo Hospital Share Price Target 2024, 2025, 2027, 2030, 2040

Today, in this blog about Apollo Hospital Share Price Target we are trying to give investors a unique idea. Before investing in any share, you should know each & every detail about the share in times of huge ups and downs in every share market. We did the research and took advice from experts to make this blog about the company’s growth, performance, etc.

Apollo Hospital Share Price Target is a trading share in the share market. In this article, we will discuss the company’s financial growth, business policy, shareholding pattern, and forecast share price yearly. We use expert data and analysis to understand the Apollo Hospital Share Price Target 2024 to 2040.

What Is Apollo Hospital Enterprise Limited?

Apollo Hospital Enterprise Limited is an Indian multinational healthcare group established in 1983. The headquarters of the group is situated in Chennai, Tamil Nadu. The founder of the group is Mr. Prathap C. Reddy. With many hospital chains, the company also operates diagnostic centers, telehealth clinics, digital healthcare services, and primary care among other subsidiaries.

Fundamental Analysis Of Apollo Hospital Enterprise

| Company Name | Apollo Hospitals Enterprise Limited |

| Market Cap | ₹94,712.96 Crore |

| Face Value | ₹5 |

| Book Value | ₹537.12 |

| 52 Week High | ₹6,880.23 |

| 52 Week Low | ₹4,727 |

| DIV. YIELD | 0.25% |

| P/B | 12.35 |

Financial Data Analysis Of Apollo Hospital Enterprises Limited

We need a basic idea about the company’s PE ratio, return on assets, current ratio, and return on equity. In the section below, we discuss the performance of the company. Apollo Hospital Enterprises Share Price Target also depends on the ratio described below.

| PE Ratio | Return On Assets (ROA) | Operating Profit Margin | Return On Equity (ROE) | Asset Turnover Ratio |

| 107.65 | 8.16% | 24.89% | 13.89% | 0.65% |

Dividend History Of Apollo Hospital Share

The last few years’ dividend history of Apollo Hospital Share is described below.

- For the year 2024, the final dividend history is ₹10.0000 per share.

- For the year 2023, the final dividend history was ₹9.0000 per share.

- For the year 2022, the final dividend history was ₹11.7500 per share.

- For the year 2021, the final dividend history was ₹3.0000 per share.

- For the year 2020, the final dividend history was ₹2.7500 per share.

Also Read – Cipla Share Price Target

Apollo Hospital Share Price Target From 2024 to 2030

Apollo Hospital Share Price is a bullish trend in the share market. Apollo Hospital Share is under both the Indian Stock Exchange BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). The last 6 month’s share growth was -154.10 (-2.28%), the last 1-year share growth was +1,179.15 (36.91%), the last 5 years’ share growth was +5,129.40 (348.80%). Apollo Hospital Share followed the upward trend till the last 1-month share growth was +162.75 (2.53%).

Apollo Hospital Share Price return amount was 12.45% in the last 3 months, the last 1 years share price return percentage was 37.89%, the last 3 year’s share price return percentage was 63.45% and the last 1 month’s share price return percentage was 3.84%. Apollo Hospital Share always gives good returns to investors. If anyone wants to invest in the share it will be profitable on a long-term basis. Let’s have a look at Apollo Hospitals Share Price Target from 2024 to 2040.

Apollo Hospital Share Price Target 2024

Apollo Hospital is one of the largest private hospitals which has a network of 71 owned and managed hospitals. Apollo Hospital is the first hospital to receive International healthcare accreditation by the American-based Joint Commission. The facilities offered by the hospitals are Heart Surgeries, Kidney Transplants, Liver Transplants, Robotics Surgeries, Bone Marrow Trans Plants, Joint Replacements, Chemotherapy Cycles, Radiotherapy Fraction, etc.

| Year | Apollo Hospital Share Price Target 2024 |

| 1st Price Target | ₹5,145.02 |

| 2nd Price Target | ₹7,285.41 |

Apollo Hospitals has a good ROE ratio which was 10.42% in the last 5 years which increased to 13.96% in the last 3 years and in the last 1 year it became 13.88%. The revenue amount from the pharmacy was ₹53,714 Million in the year 2022 which increased to ₹67,125 Million in the year 2023. If we look at the Apollo Hospital Share Price Target 2024 forecast, the 1st Price Target is ₹5,145.02 and the 2nd Price Target is ₹7,285.41.

Apollo Hospital Share Price Target 2025

One of the most important implementations of Apollo Hospital is using AI Applications in the medical field which helps to revolutionize healthcare by assisting in the diagnosis, treatment, and patient care. The hospital is also managed by the Information Security Management System (ISO) which applies to the Health Information Infrastructure of Data Centres and the supporting units for Medical Record Managment, IT Support, and facility management through which the hospital can maintain all patient data safely.

| Year | Apollo Hospital Share Price Target 2025 |

| 1st Price Target | ₹7,374.96 |

| 2nd Price Target | ₹8,885.44 |

The Profit Growth of the hospital decreased in the last 1 year. The last 5 year’s profit growth was 27.52% which increased to 113.52% in the last 3 years and in the last 1 year it decreased to -6.89%. The Net Profit amount was ₹1,095 Crore in March 2023 which decreased to ₹1,025 Crore in March 2024. If we look at the Apollo Hospital Share Price Target 2025 forecast, the 1st Price Target is ₹7,374.96 and the 2nd Price Target is ₹8,885.44.

Apollo Hospital Share Price Target 2027

One of the important outsourcing of Apollo Hospital is Apollo Pharmacy which is one of India’s largest branded retail pharmacy networks. The pharmacies are spread over 27 different states, 1100 cities and towns. The company provides Home Delivery services to more than 20 Million and the pharmacy stores are available in more than 400 Million overall in India. The pharmacies provide services by 24 hours providing drugs, doctor consultation, diagnostics, dental work, etc.

| Year | Apollo Hospital Share Price Target 2027 |

| 1st Price Target | ₹11,256.89 |

| 2nd Price Target | ₹13,369.63 |

The company’s Sales Growth also was -2.85% in the 5 years, which increased to 16.36% in the last 3 years and 11.56% in the last 1 year. The Net Sales amount was ₹6,615.92 Crore in March 2023 which increased to ₹7,312.85 Crore in March 2024. If we look at the Apollo Hospital Share Price Target 2027 forecast, the 1st Price Target is ₹11,256.89 and the 2nd Price Target is ₹13,369.63.

Apollo Hospital Share Price Target 2030

Apollo Hospital’s bed count number percentage was 64% in the year 2022 which increased to 65% in the year 2023. The Apollo Standards Of Clinical Care (TASCC) were applied to all branches of Apollo Hospitals to minimize outcomes for Clinical Excellence and patient safety. Apollo quality program, Apollo Mortality Review, Discharge Summary, Clinical Governance, and ICU Checklist are monitored under the process.

| Year | Apollo Hospital Share Price Target 2030 |

| 1st Price Target | ₹19,890.56 |

| 2nd Price Target | ₹21,856.41 |

The ROCE percentage of the company was 13.98%in the last 5 years which increased to 16.89% in the last 3 years which became 17.85% in the last 1 year. The Total Expenditure amount was ₹1,312.25 Crore in June 2023 which increased to ₹1,542.12 Crore in June 2024. If we look at the Apollo Hospital Share Price Target 2030 forecast, the 1st Price Target is ₹19,890.56 and the 2nd Price Target is ₹21,856.41.

Also Read – Sun Pharma Share Price Target

Apollo Hospital Share Price Target 2040

| Year | Apollo Hospital Share Price Target 2040 |

| 1st Price Target | ₹41,514.93 |

| 2nd Price Target | ₹43,142.05 |

Apollo Hospital spreads its business outside of the counter the FII investor percentage of the share also increased to 44.10% and the DII investor percentage also increased to 21.00% which is a very positive side for the company’s growth. The Tax amount of the company was ₹67.85 Crore in June 2023 which increased to ₹80.25 Crore in June 2024. If we look at the Apollo Hospital Share Price Target 2040 forecast, the 1st Price Target is ₹41,514.93 and the 2nd Price Target is ₹43,142.05.

Peers Company Of Apollo Hospital Enterprises

| Company Name | Market Cap |

| Fortis Health | ₹39,512.85 Crore |

| Aashaka Hospital | ₹250.85 Crore |

| Dr Lal PathLab | ₹26,796.52 Crore |

| Global Health | ₹28,625.96 Crore |

Some Factors Which May Change The Share Value Of Apollo Hospital

- Medical Tourism – In India applications for Medical Tourism started very early till the year 2018 many healthcare care centres started to spread it Apollo Hospital is one of them. Through this application, the revenue of the hospital started to increase.

- Medical E-Commerce – Apollo Pharmacy started a retail medicine sales market which became very profitable for hospital revenue and the buyers also who can get medicine in their address.

- Telemedicine – Through this process, patients can get online consultation facilities in different corners of the country without presenting to the hospital. Applying this method the hospital will be able to increase its patient number which affects on company’s revenue.

- Government Scheme – Many Government Schemes (like the Ayushman Bharat Scheme) may change the revenue of the hospital.

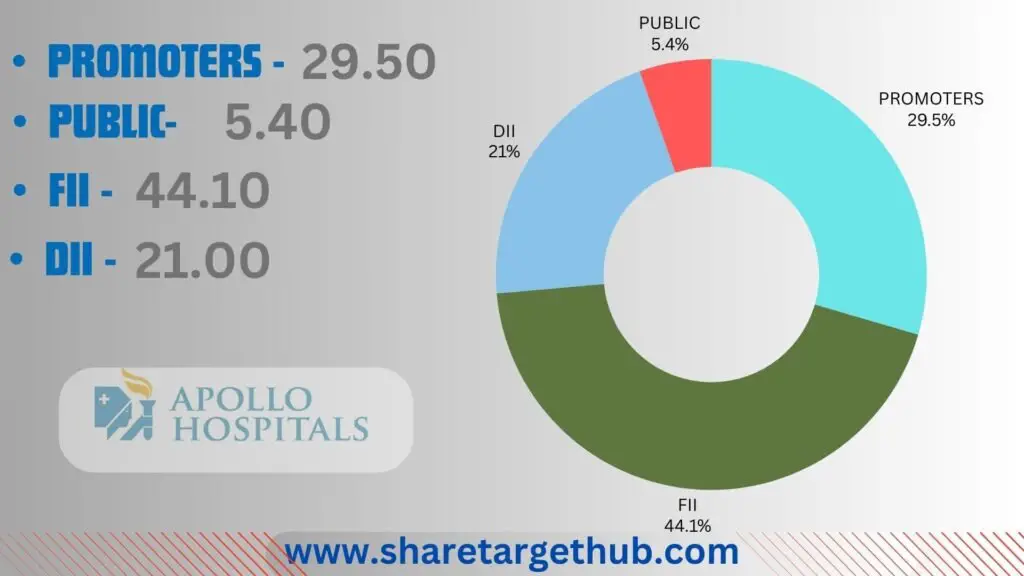

Investors Types And Ratio Of Apollo Hospital Enterprises

There are mainly four main Types of Investors in Apollo Hospitals Enterprises. The company’s growth also depended upon the ratio of investors who invested in the share.

Promoters Holding

Promoters Holding means how much capital is invested by company promoters (owner of the company) through overall capital. Apollo Hospitals Enterprises promoter holding capacity is 29.50%.

Public Holding

Public Investors are individuals who invest in the public market for profit in the future (large and small companies). Apollo Hospitals Enterprises public holding capacity is 5.40%.

FII

Foreign Institutional Investors are those big companies that invest in different countries company. Apollo Hospitals Enterprises FII is 44.10%.

DII

Domestic Institutional Investors (like Insurance, companies mutual funds) who invest in their own country. Apollo Hospitals Enterprises DII is 21.00%.

Should I invest in Apollo Hospital Share right now?

The last 3 month’s share price return percentage of Apollo Hospital Share was 12.45% and the last 1 year’s share price growth was +1,179.15 (36.91%). The FII investor percentage in the share increased to 44.10%. The company also tries to improve its overall business in different ways which may affect the share also. Apollo Hospital Share always gives good returns to investors. If anyone wants to invest in the share it will be profitable on a long-term basis. But before investing any share you should consult with any expertise.

What is the future growth of Apollo Hospital?

Positive Side

- Apollo Hospital is one of the most important pioneers in the healthcare sector using the best technology & latest equipment for healthcare.

- Apollo Hospital started to serve all types of treatment facilities including cancer also. Telemedicine & Medical E-Commerce is one of the most newly opened filled in the area of healthcare.

- By the end of the year 2030, the company also has an Aim to establish more branches (clinics, hospitals, pharmacies, operations management) in India and outside of India. The company also started to tie up in healthcare sectors like telemedicine, health insurance, etc. The company also invests in building up new projects in rural areas.

- The company also focuses on increasing operational beds in Tier 2 cities.

Risky Effects

- An increase in the cost Of medical equipment may affect the total expenditure in the hospital.

- The presence of many competitor companies may have some difficulties with grown-up individuals.

- New developments in technology day by day may become the reason for losses of the exciting medical treatment process.

Also Read – Yatharth Hospital Share Price Target

FAQ

What is Apollo Hospital Share Price Target 2024?

Apollo Hospital Share Price Target for 2024 is ₹5,145.02 to ₹7,285.41.

What is Apollo Hospital Share Price Target 2025?

Apollo Hospital Share Price Target for 2025 is ₹7,374.96 to ₹8,885.44.

What is Apollo Hospital Share Price Target 2026?

Apollo Hospital Share Price Target for 2026 is ₹9,0125.52 to ₹10,752.36.

What is Apollo Hospital Share Price Target 2027?

Apollo Hospital Share Price Target for 2027 is ₹11,256.89 to ₹13,369.63.

What is Apollo Hospital Share Price Target 2028?

Apollo Hospital Share Price Target for 2028 is ₹14,015.63 to ₹16,658.85.

What is Apollo Hospital Share Price Target 2030?

Apollo Hospital Share Price Target for 2030 is ₹19,890.56 to ₹21,856.41.

What is Apollo Hospital Share Price Target 2040?

Apollo Hospital Share Price Target for 2040 is ₹41,514.93 to ₹43,142.05.

Conclusion

Hopefully, www.sharetargethub.com will help you gain some basic ideas about the Apollo Hospital Share Price Target. By doing the research and taking advice from expertise we ensure that on a long-term basis, Apollo Hospital Share Price Target may reach a very high position. Apollo Hospital Company is related to the hospital Sector. So the demand for this sector also increases which helps the share to gain profit in the future.

If you think this website will be helpful for you then you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.