Axis Bank Share Price Target 2024, 2025, 2027, 2030, 2040

Today in our blog we will explain the basic idea about Axis Bank Share Price Target 2024, 2025, 2027, 2030, 2040. We did the research and took advice from experts to make this blog about the company’s growth, performance, etc.

Axis Bank Share Price Target is a trading share in the share market. If you are considering which is best for investment in recent times then you should know about Axis Bank Share Price Target. In this article, we will discuss the company’s financial growth, the business policy of the company, the shareholding pattern of the company, and the forecast share price every year. We use expert data and analysis to clearly explain Axis Bank Share Price Target. This article may be helpful to those who want to invest in this share right now. Let’s have a look at Axis Bank Share Price Target 2024 to 2040.

What Is Axis Bank Limited?

Axis Bank is an Indian multinational banking and financial services company. The company was established in the year 1993. The headquarters of the company is located in Mumbai. The company provided financial services to retail businesses, large and medium-sized companies, and SMEs. The company has good assets value and it is India’s third-largest private banking sector by assets.

| Company Name | Axis Bank Limited |

| Market Cap | ₹3,98,4125.56 Crore |

| P/B | 2.65 |

| Book Value | ₹487.56 |

| Face Value | ₹2 |

| 52 Week High | ₹1,3340.12 |

| 52 Week Low | ₹927.15 |

| DIV. YIELD | 0.010% |

Financial Data Analysis Of Axis Bank Limited

We need a basic idea about the company’s PE ratio, return on assets, current ratio, and return on equity. In the below portion, we discuss the performance of the company. Axis Bank Limited Share Price Target also depended upon the ratio described below.

| PE Ratio | Return On Assets (ROA) | CASA Ratio | Return On Equity (ROE) |

| 30.0 | 2.04% | 4.70% | 16.20% |

Axis Bank Share Price Target From 2024 to 2040

Axis Bank Share is a bullish trend in the share market. The share is under both the Indian Stock Exchange BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). The last 1 month’s share growth was +55.75 (4.46%), the last 6 months’ share growth was +193.85 (17.80%), the last 1 year’s share growth was +310.85 (32.00%), and the maximum share growth was +1,279.17 (37,845.70%).

Axis Bank share price return amount was 3.6% in the last 1 month, the last 1 year’s share return amount was 31.99%, the last 3 years’ share return amount was 71.86%, and the last 5 year’s share return amount was 76.24%. Axis Bank share always gives good returns to investors. If anyone wants to invest in the share it will be profitable long-term.

Also Read – Canara Bank Share Price Target

Axis Bank Share Price Target 2024

Axis Bank spreads its business in urban and domestic areas basis. In the financial year 2022, the company’s new liability relationship added amount was 8.7 million. Domestic retail loans grew 22% in the year 2022 and the amount was ₹3,98,658 Crore which includes different types of loans like home loans, Property loans, small business banking loans, personal loans, etc. The company’s wealth management AUM growth was 23% in the year 2022.

| Year | Axis Bank Share Price Target 2024 |

| 1st Price Target | 1,023.24 |

| 2nd Price Target | 1,380.69 |

The revenue amount of Axis Bank was ₹87,215.56 Crore in the year 2022 which became ₹1,08,256.76 Crore in March 2023. The ROE Percentage of the company is not so good. The last 5 years ROE was 7.30% which increased to 9.25% in the last 3 years and the last 1 year’s ROE was 7.99%. If we look at Axis Bank Share Price Target 2024 forecast the 1st Price Target is ₹1023.24 and the 2nd Price Target is ₹1380.69.

Axis Bank Share Price Target 2025

The overall performance of the company also growing. The total Savings Account number was 29 Million in the year 2022. This year the company’s added card number was 2.68 Million which increased 172% compared to the previous year 2021. The company’s Flipkart Axis Bank Credit Card facility is one of the successful portfolios that launched in the year 2019 and will reach number to 2.3 million by the year 2022. By providing a Credit Cards facility the company became 4th largest company in India.

| Year | Axis Bank Share Price Target 2025 |

| 1st Price Target | 1,420.45 |

| 2nd Price Target | 1,745.88 |

The net profit amount was ₹6,125.25 Crore in December 2023 which became ₹7,256.69 Crore in March 2024. The tax amount was ₹2,045.58 Crore in December 2023 which became ₹2,320.52 Crore in March 2024. If we look at Axis Bank Share Price Target 2025 forecast the 1st Price Target is ₹1,420.45 and the 2nd Price Target is ₹1,745.88.

Axis Bank Share Price Target 2027

Axis Bank also provides different types of Insurance facilities like Life Insurance, General Insurance, Health Insurance, Pradhan Mantri Suraksha Bima Yojna, etc. One of the most important sides of the bank is providing banking facilities online. The open fixed deposit percentage increased by 69% in the year 2022 which was done by the digital network, the personal loans distribution percentage increased by 47%, and the credit card issuing percentage increased by 71% in the year 2022 compare to the year 2021.

| Year | Axis Bank Share Price Target 2027 |

| 1st Price Target | 2,063.54 |

| 2nd Price Target | 2,385.20 |

As the company spreads its business outside the country the FII investor of the company is good which is 52.80% which is a very good side of the company’s growth. The total income amount was ₹101,745.23 Crore in March 2023 which became ₹132,458.52 Crore in March 2024. If we look at Axis Bank Share Price Target 2025 forecast the 1st Price Target is ₹2,063.54 and the 2nd Price Target is ₹2,385.20.

Axis Bank Share Price Target 2030

Axis Bank also provides loans in different segments like Gold Loan, Car Loan, Two Wheeler Loan, Educational Loan, etc. The company also provides some Government Savings Schemes for the Public Provident Fund, Kisan Vikas Patra, and Sukanya Samriddhi Yojana. Axis Bank also provides Government Pension Schemes like Atal Pension Yojana. Axis Bank has 2,123 branches in India, 387 customer Service Points, has 135 business correspondent banking outlets for providing banking facilities.

| Year | Axis Bank Share Price Target 2030 |

| 1st Price Target | 3,169.75 |

| 2nd Price Target | 3,469.12 |

The total operating expenses amount was ₹39,758.56 Crore in March 2023 which decreased to ₹35,325.85 Crore in March 2024. The total expenditure amount was ₹92,185.98 Crore in March 2023 which became ₹107,966.58 Crore in March 2024. If we look at Axis Bank Share Price Target 2025 forecast the 1st Price Target is ₹3,169.75 and the 2nd Price Target is ₹3,469.12.

Also Read – SBI Share Price Target

Axis Bank Share Price Target 2040

Axis Bank company’s per-share earning amount was ₹22.18 Crore in the year 2020-21 which became ₹25.78 Crore in the year 2021-22. In the year 2022, the company’s wholesale loan book increased by 92% with different types of SEcured loans. The company’s overall AUM amount was ₹197,478 Crore in the financial year 2020-2021 which increased to ₹260,989 Crore in the financial year 2021-22 which increased 44% CAGR in the last 3 year’s.

| Year | Axis Bank Share Price Target 2040 |

| 1st Price Target | 6,804.34 |

| 2nd Price Target | 7,164.34 |

The ROA percentage of the company is not so good. In the last 5 years, ROA was 0.8% which became 0.90% in the last 3 years and in the last 1 year, ROA percentage was 0.78%. The Net Non-Performing Assets (NPA) percentage was 1.18% in the last 5 years which became 0.79% in the last 3 years and in the last 1 year, it decreased to 0.40%. If we look at Axis Bank Share Price Target 2040 forecast the 1st Price Target is ₹6,804.34 and the 2nd Price Target is ₹7,164.34.

Peer’s Company of Axis Bank Limited

- Bandhan Bank

- City Union Bank

- CSB Bank

- Equitas Bank

- DCB Bank

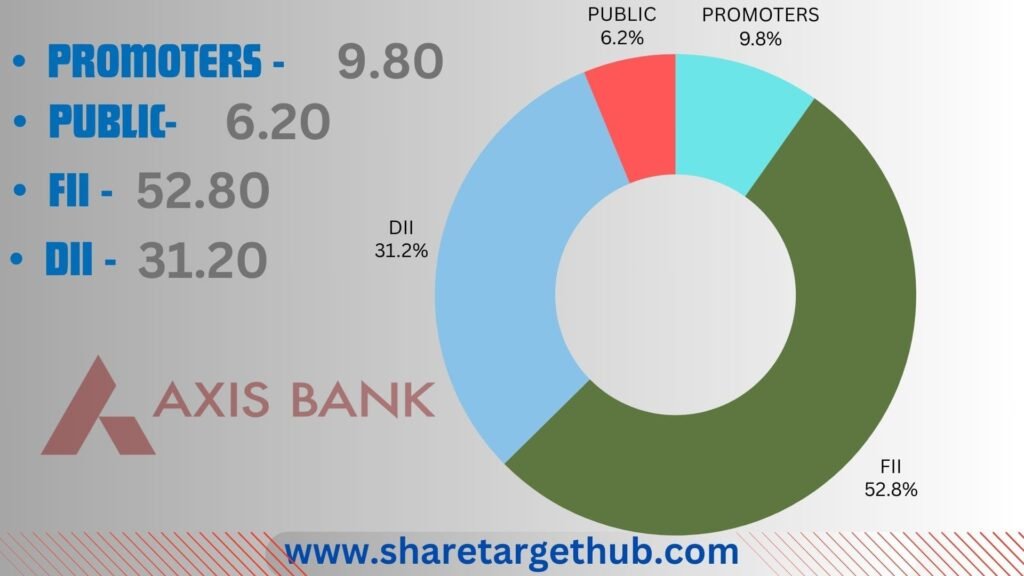

Investors Types And Ratio Of Axis Bank Limited

There are mainly Four main Types of Investors in Axis Bank Limited. The company’s growth also depended upon the ratio of investors who invested in the share.

Promoters Holding

Promoters Holding means how much capital is invested by company promoters (owner of the company) through overall capital. Axis Bank Limited Company’s promoter holding capacity is 9.80%.

Public Holding

Public Investors are individuals who invest in the public market profit in the future (large and small companies). Axis Bank Limited Company’s public holding capacity is 6.20%.

FII

Foreign Institutional Investors are those big companies that invest in different countries company. Axis Bank Limited Company’s FII is 52.80%.

DII

Domestic Institutional Investors (like Insurance, companies, and mutual funds) who invest in their own country. Axis Bank Limited Company’s DII is 31.20%.

Advantages and Disadvantages Of Axis Bank Share

Every share has some advantages and some disadvantages also. So, the Axis Bank Share Price Target also has some advantages and disadvantages described below.

Advantages

- In the last 3 years, the profit growth of the company was 81.23%.

- The CASA Ratio of the company was 1.33%.

- The revenue amount of the company increased in the last quarter.

- The book value amount of the company has increased in the last 2 years.

- The company is increasing with zero promoter pledges.

- The company has a good Capital Adequacy Ratio of 18.23%.

Disadvantages

- The company has a high cost of income ratio which is 67.12%.

- The company’s cash-generating ratio from core business is decreased yearly basis.

- The company maintains a poor ROE ratio which is 7.99%.

Also Read – HDFC Bank Share Price Target

FAQ

Who is the CEO of Axis Bank?

Mr. Amitabh Chaudhry is the CEO of Axis Bank.

Is Axis Bank a MNC Company?

Yes, Axis Bank is an MNC banking sector.

Should I invest in Axis Bank Share right now?

The last 6 months’ share growth of Axis Bank was 13.39%, and the last 1 year’s share price return amount was 24.23%. The FII investment percentage of the share is also very good which is 52.80%. Axis Bank share always gives good returns to investors. If anyone wants to invest in the share it will be profitable on a long-term basis.

What is the future prediction of Axis Bank?

The last 3 years profit growth of the company was 81.23% the revenue growth of the company also increased. The DII investors percentage of the company is also very good 31.20%. The company spread its business all over India. It will grow more in the coming future.

What is the Axis Bank Share Price Target for 2024?

Axis Bank Share Price Target for 2024 is ₹1,023.24 to ₹1,380.69.

What is the Axis Bank Share Price Target for 2025?

Axis Bank Share Price Target for 2025 is ₹1,420.45 to ₹1,745.88.

What is the Axis Bank Share Price Target for 2027?

Axis Bank Share Price Target for 2027 is ₹2,063.54 to ₹2,385.20.

What is the Axis Bank Share Price Target for 2028?

Axis Bank Share Price Target for 2028 is ₹2,415.32 to ₹2,689.74.

What is the Axis Bank Share Price Target for 2030?

Axis Bank Share Price Target for 2030 is ₹3,169.75 to ₹3,469.12.

What is the Axis Bank Share Price Target for 2035?

Axis Bank Share Price Target for 2035 is ₹4425.24 to ₹4725.69.

What is the Axis Bank Share Price Target for 2040?

Axis Bank Share Price Target for 2040 is ₹6,804.34 to ₹7,164.34.

Conclusion

Hopefully, www.sharetargethub.com will help you gain some basic ideas about the Axis Bank Share Price Target. By doing the research and taking advice from the experts we ensure that on a long-term basis, Axis Bank Share Price Target may reach a very high position. Axis Bank is mainly related to the banking Sector. So the demand for this sector also increases which helps the share to gain profit in the future.

If you think this website will be helpful for you then you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.