Mahindra and Mahindra Share Price Target 2024, 2025, 2027, 2030, 2040

Today in our blog we will explain the basic idea about Mahindra and Mahindra Share Price Target 2024, 2025, 2027, 2030, 2040. We did the research and took advice from experts to make this blog about the company’s growth, performance, etc.

Mahindra and Mahindra Share Price Target is a trading share in the share market. If you are considering which is best for investment in recent times then you should know about Mahindra and Mahindra Share Price Target. In this article, we will discuss the company’s financial growth, the business policy of the company, the shareholding pattern of the company, and the forecast share price every year. We use expert data and analysis to clearly explain Mahindra and Mahindra Share Price Target. This article may be helpful to those who want to invest in this share right now. Let’s have a look at Mahindra and Mahindra Share Price Target 2024 to 2040.

What Is Mahindra and Mahindra Limited Company?

Mahindra and Mahindra is an automobile manufacturing company that was established in the year 1945. The company’s headquarters is situated in Mumbai and is a part of Mahindra Group. One of the company’s units is Mahindra Tractors, one of the world’s largest tractor-manufacturing units.

| Company Name | Mahindra & Mahindra Limited Company |

| Market Cap | ₹3,49,710.15 Crore |

| Face Value | ₹5 |

| Book Value | ₹421.25 |

| P/B | 6.75 |

| DIV. YIELD | 0.85% |

| 52 Week High | ₹3,013.50 |

| 52 Week Low | ₹1,415.75 |

Financial Data Analysis Of Mahindra and Mahindra Limited

We need a basic idea about the company’s PE ratio, return on assets, current ratio, and return on equity. In the below portion, we discuss the performance of the company. Mahindra and Mahindra Company Limited’s Share Price Target also depended upon the ratio described below.

| PE Ratio | Return On Assets (ROA) | Current Ratio | Return On Equity (ROE) |

| 30.35 | 4079% | 1.32 | 20.12% |

History Of Mahindra and Mahindra Share Price Target From 2024 to 2040

Mahindra and Mahindra Share is a bullish trend in the share market. Mahindra and Mahindra is under both the Indian Stock Exchange BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). The 6-month share growth was +1,213.80 (76.08%), the last 1 year’s share growth was +1,26045 (81.37%), the last 5 years’ share growth was +2,241.70 (397.25%) and the maximum share growth was +2,786.10 (13,425.78%).

Mahindra and Mahindra share price return amount was 34.26% in the last 3 months, the last 1 year’s share price return amount was 84.27%, the last 3 years’ share price return amount was 207.08% and the last 5 year’s share price return amount was 396.88%. Mahindra and Mahindra Share Price always gives good returns to investors. If anyone wants to invest in the share it will be profitable long-term.

Also Read – Tata Motors Share Price Target

Mahindra and Mahindra Share Price Target 2024

With the help of Mahindra and Mahindra Company, the Indian automotive industry is growing rapidly. All automotive segments like passenger Vehicles, Commercial Vehicles, Three-wheelers, and two-wheelers reported the highest sales. The growth of the Electrical Vehicles Segment is noticeable and both the state government and central governments are focusing more on the growth of the environment-friendly mobility sector.

| Year | Mahindra and Mahindra Share Price Target 2024 |

| 1st Price Target | 2,425.89 |

| 2nd Price Target | 3,082.56 |

The revenue amount of the company was ₹90,456.58 Crore in 2022, which became ₹1,22,356.89 Crore in 2023. The operating profit amount was ₹3,336.56 Crore in March 2022 which became ₹3,458.56 Crore in March 2023. If we look at the Mahindra and Mahindra Share Price Target 2024 forecast, the 1st Price Target is ₹2,425.89 and the 2nd Price Target is ₹3,082.56.

Mahindra and Mahindra Share Price Target 2025

In the Financial year 2017, the Automotive Sales amount was 4,79,523 which increased to 11.5% and became 5,21,356 in the year 2018. In the farm equipment segment, the company has an important role. The company launched a tractor brand Trakstar which has the highest selling rate the company first launched a driverless tractor brand in India. The company has the highest tractor export record of 16,589 in the year 2018. The company has an important role in the passenger vehicles sector.

| Year | Mahindra and Mahindra Share Price Target 2025 |

| 1st Price Target | 3,185.23 |

| 2nd Price Target | 3,385.45 |

The profit amount of the company also increased, the last 5 year’s profit growth was 8.7% which increased to 70.12% in the last 3 years, and in the last 1 year, the percentage decreased to 35.23%. The net profit amount was ₹4,870.23 Crore in March 2022 which became ₹6,650.23 Crore in March 2023. If we look at the Mahindra and Mahindra Share Price Target 2025 forecast, the 1st Price Target is ₹3,185.23 and the 2nd Price Target is ₹3,385.45.

Mahindra and Mahindra Share Price Target 2027

In the farm equipment sector, the tractor sales amount was 2,49,625 in 2017, which increased to 22.7% in 2018 and became 3,03,125 in 2018. The company has launched many new products like NUVO, JIVO, and JIVO. The company made a strong market view of Farm Machinery products in domestic and international markets. The company has a total of 39 manufacturing unit facilities in India out of which 6 plants are situated in the USA, 7 plants are situated in Africa, 16 plants are situated in India and others are in different countries.

| Year | Mahindra and Mahindra Share Price Target 2027 |

| 1st Price Target | 3,845.52 |

| 2nd Price Target | 4,174.33 |

The sales amount of the company also increasing. In the last 5 years sales amount was 11.87% which became 24.23% in the last 3 years and in the last 1 year sales growth was 48.12%. The net sales amount was ₹57,789.56 Crore in March 2022 which increased to ₹84,970.56 Crore in March 2023. If we look at the Mahindra and Mahindra Share Price Target 2027 forecast, the 1st Price Target is ₹3,845.52 and the 2nd Price Target is ₹4,174.33

Also Read – TVS Motor Share Price Target

Mahindra and Mahindra Share Price Target 2030

The company also built Military Vehicles from the year 1947. The company’s manufacturing product Willys Jeep was very famous at that time. The company also manufactures metallic components for aerospace and has a deal with Airbus Group. In the year 2002, the Mahindra and Mahindra company entered the energy sector to generate electric power through the company’s powerful engines and Diesel generator sets (whose total number is approximately 450,000).

| Year | Mahindra and Mahindra Share Price Target 2030 |

| 1st Price Target | 4,852.63 |

| 2nd Price Target | 5,148.25 |

As Mahindra and Mahindra Limited spread its business outside of India the FII investor of the company is in a very high position which is 42.50% which is a very good point for the company’s growth. The ROE Percentage of the company was 10.28% in the last 5 years which increased to 10.95% in the last 3 years which increased to 16.26% in the last 1 year. If we look at the Mahindra and Mahindra Share Price Target 2030 forecast, the 1st Price Target is ₹4,852.63 and the 2nd Price Target is ₹5,148.25.

Mahindra and Mahindra Share Price Target 2040

Mahindra Company’s tractors are present in moreover 40 countries including India, China, the United States, New Zealand, Sudan, and many others country. In the year 2021, the company launched the next-generation Yuvo tractor platform named Yuvo Tech Plus. The company also launched Mahindra’s Electric Car which gives a platform for the company’s growth. In the year 2020, the company launched the second generation Thar, in the year 2022 the company launched Scorpio N.

| Year | Mahindra and Mahindra Share Price Target 2040 |

| 1st Price Target | 9,436.12 |

| 2nd Price Target | 9,744.23 |

The total expenditure amount was ₹19,812.56 Crore in March 2023, which became ₹21,995.58 Crore in March 2024. The tax amount was ₹163.25 Crore in March 2023 which became ₹613.25 Crore in March 2024. If we look at the Mahindra and Mahindra Share Price Target 2030 forecast, the 1st Price Target is ₹9,436.12 and the 2nd Price Target is ₹9,744.23.

Peer’s Company of Mahindra and Mahindra Limited

- AASTAFIN

- Abhinav Leasing

- Acme Resources

- Alfavision Sec

- Alps Motor Fin

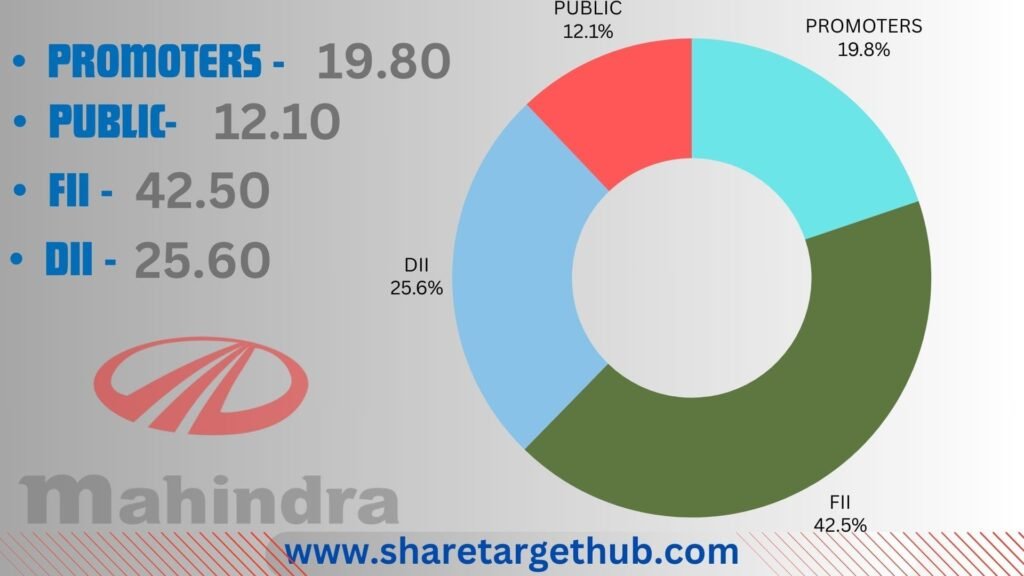

Investors Types And Ratio Of Mahindra and Mahindra Limited

There are mainly Four main Types of Investors in Mahindra and Mahindra Limited. The company’s growth also depended upon the ratio of investors who invested in the share.

Promoters Holding

Promoters Holding means how much capital is invested by company promoters (owner of the company) through overall capital. Mahindra and Mahindra Limited Company’s promoter holding capacity is 19.80%.

Public Holding

Public Investors are individuals who invest in the public market profit in the future (large and small companies). Mahindra and Mahindra Limited Company’s public holding capacity is 12.10%.

FII

Foreign Institutional Investors are those big companies that invest in different countries company. Mahindra and Mahindra Limited Company’s FII is 42.50%.

DII

Domestic Institutional Investors (like Insurance, companies, and mutual funds) who invest in their own country. Mahindra and Mahindra Limited Company’s DII is 25.60%.

Advantages and Disadvantages Of Mahindra and Mahindra Share

Every share has some advantages and some disadvantages also. So, the Mahindra and Mahindra Share Price Target also has some advantages and disadvantages described below.

Advantages

- In the last 3 years, the company has shown good profit growth which was 70.12%.

- In the last 3 years, the revenue growth of the company was good which is 24.12%.

- The company has a small amount of debt and the company has a good interest cover ratio which is 18.87%.

- The company has good cash flow management, PAT stands for 1.86.

- The book value amount per share also increasing.

Disadvantages

- In the last 1 year, the profit amount of the company decreased.

- MFs decreased their shareholding capacity in the last quarter.

Also Read – Castrol India Share Price Target

FAQ

Who is the Managing Director of Mahindra & Mahindra company?

Dr. Anish Shah is the managing director of Mahindra & Mahindra Company.

What was the previous name of Mahindra and Mahindra Company?

In the year 1945, the company was established as Mahindra & Mohammed later it was named Mahindra and Mahindra

What is the main Speciality of Mahindra & Mahindra Company?

The Mahindra & Mahindra company is famous for its powerful and long-lasting engines. The company launched famous models one by one from the establishment time to now.

Should I invest in Mahindra and Mahindra Share right now?

The last 6 months’ share growth of the company was 61.32%, the last 1 year’s share price return amount of the company was 102.23%. The FII investor’s percentage of the share is 42.50%. If anyone wants to invest in the share it will be profitable on a long-term basis.

What is the Mahindra and Mahindra Share Price Target for 2024?

The Mahindra and Mahindra Share Price Target for 2024 is ₹2,425.89 to ₹3,082.56.

What is the Mahindra and Mahindra Share Price Target for 2025?

The Mahindra and Mahindra Share Price Target for 2025 is ₹3,185.23 to ₹3,385.45.

What is the Mahindra and Mahindra Share Price Target for 2027?

The Mahindra and Mahindra Share Price Target for 2027 is ₹3,845.52 to ₹4,174.33.

What is the Mahindra and Mahindra Share Price Target for 2030?

The Mahindra and Mahindra Share Price Target for 2030 is ₹4,852.63 to ₹5,148.25.

What is the Mahindra and Mahindra Share Price Target for 2040?

The Mahindra and Mahindra Share Price Target for 2040 is ₹9,436.12 to ₹9,744.23.

Conclusion

Hopefully, www.sharetargethub.com will help you gain some basic ideas about the Mahindra and Mahindra Share Price Target. By doing the research and taking advice from the experts we ensure that on a long-term basis, Mahindra and Mahindra Share Price Target may reach a very high position. Mahindra and Mahindra company is mainly related to the Automobile Manufacturing Sector. So the demand for this sector also increases which helps the share to gain profit in the future.

If you think this website will be helpful for you then you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.