ICICI Bank Share Price Target 2024, 2025, 2027, 2030, 2040

Today in our blog we will explain the basic idea about ICICI Bank Share Price Target 2024, 2025, 2027, 2030, 2040. We did the research and took advice from experts to make this blog about the company’s growth, company’s performance, etc.

ICICI Bank Share Price Target is a trading share in the share market. In this article, we will discuss the company’s financial growth, the company’s business policy, the company, the shareholding pattern of the company, and the forecast share price every year. We use expert data and analysis to give a clear knowledge of ICICI Bank Share Price Target. This article may be helpful to those who want to invest in this share right now. Let’s have a look at ICICI Bank Share Price Target 2024 to 2040.

What is ICICI Bank Limited?

ICICI Bank Limited is an Indian multinational banking sector that provides banking and financial services to all India bases. The headquartered is situated in Mumbai. The company was established in the year 1994, 5th January. The ICICI Bank has a network of branches of 3,900 and 12,700 ATMs in India. and 19 other Countries.

| Company Name | ICICI Bank Limited |

| Market Cap | ₹8,79,912.23 Crore |

| Book Value | ₹333.56 |

| Face Value | ₹2 |

| 52 Week High | ₹1,259.23 |

| 52 Week Low | ₹898.85 |

| P/B | 3.40 |

| DIV. YIELD | 0.80% |

Financial Data Analysis Of ICICI Bank Limited

We need a basic idea about the company’s PE ratio, return on assets, current ratio, and return on equity. In the below portion, we discuss the performance of the company. ICICI Bank Share Price Target also depended upon the ratio described below.

| PE Ratio | Return On Assets (ROA) | CASA Ratio | Return On Equity (ROE) |

| 21.10 | 2.14% | 45.23% | 18.8% |

History Of ICICI Bank Share Price Target From The Year 2024 to 2040

ICICI Bank Share is a bullish trend in the share market. ICICI Bank is under the both Indian Stock Exchange BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). The last 6 month’s share growth was +220.60 (21.44%), the last 1 year’s share growth was +252.65 (25.34%), the last 5 year’s share growth was +839.35 (204.57%) and the maximum share growth was +1,245.57 (30,528.68%).

ICICI Bank Share Price return amount was 17.0% in the last 3 months, the last 1 year’s share return amount was 28.27%, the last 3 year’s share return amount was 90.37% and the last 5 years’ share return amount was 204.33%. ICICI Bank always gives good returns to investors if anyone wants to invest in the share it will be profitable on a long-term basis. Let’s have a look at ICICI Bank Share Price Target from the year 2024 to 2040.

Also Read – Canara Bank Share Price Target

ICICI Bank Share Price Target 2024

ICICI Bank provides different Insurance facilities like Health Insurance, Life Insurance, Vehicle Insurance, Travel Insurance, etc. One of the Health Insurance is Heart and Cancer Insurance. In the case of Cancer treatment, the claim amount can cover up to 40 lakh. Through ICICI Bank’s Health Insurance Facilities, the policyholders can get cashless hospitalization facilities in the case of any accident or Illness with more than 6500 health network providers.

| Year | ICICI Bank Share Price Target 2024 |

| 1st Price Target | 1,125 |

| 2nd Price Target | 1,825 |

The profit after-tax growth percentage of ICICI Bank was 11.0%, the amount was ₹1,919 Crore in the financial year 2024 and the amount was ₹1,729 Crore in the year 2023. The net profit amount was ₹24,441.51 Crore in March 2022 which became ₹31,999.56 Crore in March 2023. If we look at ICICI Bank Share Price Target 2024, the 1st Price Target is ₹1,125 and the 2nd Price Target is ₹1,825.

ICICI Bank Share Price Target 2025

In the year 2020, ICICI Bank launched a digital banking facility named ICICI STACK which provides online services such as payments, digital accounts, insurance, instant loan facilities, etc for individuals, merchants, and corporate providers. ICICI Bank also offers Business Credit Cards with provide interest-free credit periods. The bank also provides the facility of ICICI debit cards.

| Year | ICICI Bank Share Price Target 2025 |

| 1st Price Target | 1,910 |

| 2nd Price Target | 2,560 |

The total income amount was ₹1,30,123.56 Crore in March 2023 which became ₹166,548.56 Crore in March 2024. The Net Interest Margin (NIM) percentage was 3.50% in the last 5 years which became 3.70% in the last 3 years in the last 1 year it became 5.12% in the last 1 year. If we look at the ICICI Bank Share Price Target 2025 forecast, the 1st Price Target is ₹1,910 and the 2nd Price Target is ₹2,560.

ICICI Bank Share Price Target 2027

ICICI Bank also provides Personal Loan, Home Loan, Car Loan, Gold Loan, Home Loan, Two Wheeler Loan, Educational Loan, and Gold Loan. ICICI Bank offers Home loan facilities up to ₹5 Crore with an interest rate of 8.5% per annum all the processes are also available through an online process, providing Car Loan with an interest of 9.99% per annum, providing Home Loans of 7.80% per annum.

| Year | ICICI Bank Share Price Target 2027 |

| 1st Price Target | 3,455 |

| 2nd Price Target | 3,960 |

The ROE percentage of the company is also increasing. In the last 5 years, the ROE percentage was 12.12% which increased to 16.23% in the last 3 years, and in the last 1 year, it increased to 18.25%. The revenue amount of the company was ₹1,58,538.35 Crore in 2022 which became ₹1,87,182.90 Crore in 2023. If we look at ICICI Bank Share Price Target 2027 the 1st Price Target is ₹3,455 and the 2nd Price Target is ₹3,960.

ICICI Bank Share Price Target 2030

ICICI Bank provides deposits like Savings Accounts, Fixed Deposits, and Fixed Deposits with Monthly Income options. ICICI Lombard Voyager also provides Travel Insurance Facilities that will take care of any uncertainties in Travel Periods.

| Year | ICICI Bank Share Price Target 2030 |

| 1st price Target | 5,160 |

| 2nd Price Target | 5,689 |

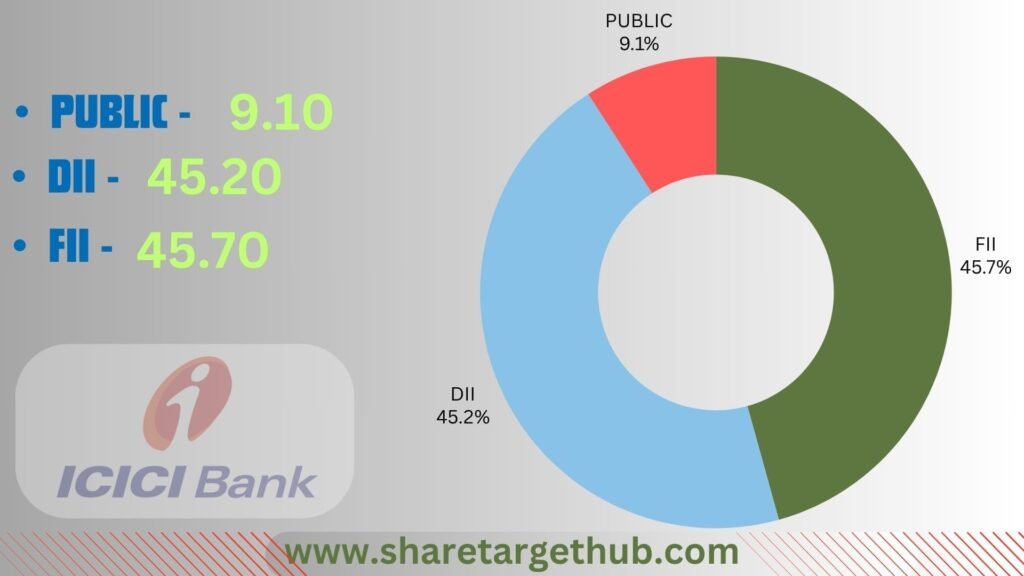

As the company spreads its business outside of India the FII investor percentage of the company is good which is 44% to 45% which means many foreign investors are showing interest in investing in the share. The DII investor percentage of the company is good is 45.20% which is also a very positive part of the company’s growth. If we look at the ICICI Bank Share Price Target 2030 forecast, the 1st Price Target is ₹5,160 and the 2nd Price Target is ₹5,689.

Also Read – HDFC Bank Share Price Target

ICICI Bank Share Price Target 2040

In the year 2019, ICICI Bank introduced the InstaBIZ app which offers banking services to micro, small, and medium customers to different banks. In recent times active user number is 1.6 billion. The subsidiaries of the company are situated in the United Kingdom, Hong Kong, Oman, Dubai International Finance Centre, China, and many other places. In the year 2010 ICICI Bank acquired the Bank Of Rajasthan (BOR) for ₹30 billion.

| Year | ICICI Bank Share Price Target 2040 |

| 1st Price Target | 10,800 |

| 2nd Price Target | 11,630 |

The ROA percentage of the company is not so good. In the last 5 years, ROA was 1.29% which became 1.89% in the last 3 years. In the last 1 year, the percentage became 2.15%. The NPA (Non-Performing Assets amount was ₹28.01% in December 2023 which became ₹29.12% in March 2024. If we look at the ICICI Bank Share Price Target 2040 forecast, the 1st Price Target is ₹10,800 and the 2nd Price Target is ₹11,630.

How To Purchase ICICI Bank Share?

The most common trading platform for purchasing the ICICI Bank Share is described below.

- Zerodha

- Upstox

- Groww

- Angelone

Peer’s Company of ICICI Bank Limited

- Axis Bank

- Bandhan Bank

- City Union Bank

- CSB Bank

- City Union Bank

Investors Types And Ratio Of ICICI Bank Limited

There are mainly three main Types of Investors in ICICI Bank Limited. The company’s growth also depended upon the ratio of investors who invested in the share.

Public Holding

Public Investors are individuals who invest in the public market for profit in the future (large and small companies). ICICI Bank Limited Company’s public holding capacity is 9.10%.

FII

Foreign institutional investors are those big companies that invest in companies in different countries. ICICI Bank Limited Company’s FII is 45.70%.

DII

Domestic Institutional Investors (like Insurance, companies, and mutual funds) who invest in their own country. ICICI Bank Limited Company’s DII is 45.20%.

Advantages and Disadvantages Of ICICI Bank Share

Every share has some advantages and some disadvantages also. So, the ICICI Bank Share Price Target also has some advantages and disadvantages described below.

Advantages

- The company has maintained a healthy ROE ratio which is 18.25% in the last 1 year.

- The company has shown a good profit growth in the last 3 years which is 59.12%.

- The CASA Ratio shows 45.23% of total deposits.

- The NIM ratio shows was 5.12% in the last 1 year.

- The Book value amount of the share has increased in the last 2 years.

- The company’s capital adequacy ratio is 19.12%.

Disadvantages

- The company’s operating income has decreased in the last 1 year.

- MFs decreased their shareholding capacity in the last quarter.

Also Read – Bajaj Finance Share Price Target

FAQ

What is the full form of ICICI Bank?

The full form of ICICI Bank is Industrial Credit and Investment Corporation Of India.

Who is the CEO of ICICI Bank?

Mr. Sandeep Bakhshi is the CEO of ICICI Bank.

Is ICICI Bank a private or Government Sector?

ICICI Bank is a leading private-sector Bank.

What is the future prediction of ICICI Bank Limited?

The profit growth of ICICI Bank is 59.12% in the last 3 years. The ROE ratio of the company is also very good which is 18.25% in the last 1 year’s. As the company is a very old company and people has trust on it. In the finance sector, the company will grow more in the coming future.

Should I invest in ICICI Bank Share right now?

The 6-month’s share growth of ICICI Bank was 19.72% and the 1-year’s share return amount was 20.23%. The FII investor of the company is good which is 45.70% and the DII investor percentage is 45.20%. The ICICI Bank always gives good returns to investors. If anyone wants to invest in the share it will be profitable on a long-term basis.

What is the ICICI Bank Share Price Target for 2024?

ICICI Bank Share Price Target for 2024 is ₹1,125 to ₹1,825.

What is the ICICI Bank Share Price Target for 2025?

ICICI Bank Share Price Target for 2025 is ₹1,910 to ₹2,560.

What is the ICICI Bank Share Price Target for 2027?

ICICI Bank Share Price Target for 2027 is ₹3,455 to ₹3,960.

What is the ICICI Bank Share Price Target for 2028?

ICICI Bank Share Price Target for 2028 is ₹4,125 to ₹4,658.

What is the ICICI Bank Share Price Target for 2030?

ICICI Bank Share Price Target for 2030 is ₹5,160 to ₹5,689.

What is the ICICI Bank Share Price Target for 2035?

ICICI Bank Share Price Target for 2035 is ₹8,725 to ₹9480.

What is the ICICI Bank Share Price Target for 2040?

ICICI Bank Share Price Target for 2040 is ₹10,800 to ₹11,630.

Conclusion

Hopefully, www.sharetargethub.com will help you gain some basic ideas about the ICICI Bank Share Price Target. By doing the research and taking advice from expertise we ensure that on a long-term basis, ICICI Bank Share Price Target may reach a very high position. ICICI Bank Limited Company is related to the banking sector. So the demand for this sector also increases which helps the share to gain profit in the future.

If you think this website will be helpful for you then you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.