Tata Steel Share Price Target 2024, 2025, 2027, 2030

If you think about which share will be best for investment in recent times then you should know about Tata Steel Share Price Target. Today in our blog we will explain the basic idea about Tata Steel Share Price Target 2024, 2025, 2027, 2030. We did the research and took advice from experts to make this blog about the company’s growth, performance, etc.

Tata Steel Share Price Target is a trading share in the share market. In this article, we will discuss the company’s financial growth, the business policy of the company, the shareholding pattern of the company, and the forecast share price yearly. We use expert data and analysis to give a clear knowledge of Tata Steel Share Price Target. This article may be helpful to those who want to invest in this share right now. Let’s look at Tata Steel Share Price Target 2024 to 2030.

What Is Tata Steel Company?

Tata Steel Limited formerly known as Tata Iron and Steel Company is an Indian multinational steel manufacturing company situated in Jamshedpur, Jharkhand. The headquarters of the company is situated in Mumbai. The company was established in the year 1907, on 26th August.

Overview Of Tata Steel Company

Tata Steel is one of the largest steel manufacturing units in India which has the production capacity of crude steel 35 million tonnes per annum. In the year 2021, the most profitable company of Tata Group was Tata Steel. In the year 2005, the company changed its name to Tata Steel Ltd from Tata Iron and Steel Company (TISCO). The main products of the company are long steel products, wire products, steel-causing pipes, and housing hold goods.

| Company Name | Tata Steel Ltd |

| Established | In 1907, 26th August |

| Market Cap | ₹2,08,750.56 Crore |

| Book Value | ₹110.69 |

| Face Value | ₹1 |

| 52 Week High | ₹185.10 |

| 52 Week Low | ₹114.25 |

| P/B | 1.56 |

| DIV. YIELD | 2.20% |

Jamsetji Nusserwanji Tata founded Tata Iron and Steel Company (TISCO), In the year 1911 TISCO started to produce pig iron products, and in the year 1912, the company started to produce steel, during the First World War company made rapid progress in steel production. In 2005, Tata Steel Company acquired a majority stake in the Thailand-based steelmaker Millennium Steel at a total cost of $135 million the company was newly named Tata Steel Thailand. Tata Steel, SAIL, and Jindal Steel and Power are the only three Indian Steel manufacturing units that have their captive iron ore mines which is the most advantageous part of the company.

Financial Data Analysis Of Tata Steel Ltd Company

Before investing any share anyone wants to see the company’s performance, overall profit, and net sales amount. We need a basic idea about the company’s PE ratio, return on assets, current ratio, and return on equity. In the below portion, we discuss the performance of the company. Tata Steel Share Price Target also depended upon the ratio which is described below.

PE Ratio (Price To Earning Ratio)

PE Ratio is calculated by Market price per share Earning price per share. It means the number of times an investor is ready to pay as compared to earnings time. Tata Steel Ltd Company has a PE ratio of 44.01, which is overvalued.

Return on Assets (ROA)

ROA is calculated by Profit After tax ÷ Total Assets. ROA is influenced by 2 factors return on sales and asset turnover. Tata Steel Ltd Company has a ROA of 1.99%, which is a bad sign for the company’s growth.

Current Ratio

The current Ratio is calculated by Current Assets ÷ Current Liabilities. Tata Steel Ltd Company has a current ratio of 0.74.

Return On Equity (ROE)

ROE is measured by = Net profit ÷ Average Share holding equity. Tata Steel Ltd Company has an ROE of 3.54%, higher is better.

Also Read- Hindustan Copper Share Price Target

History Of Tata Steel Share Price Target From The Year 2024 to 2030

Tata Steel Share is under BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). Tata Steel Share is a bullish trend in the share market. The last 1 month’s share growth decreased to -13.87 (-7.66%), the last 6 month’s share growth was +30.00 (21.86%), the last 1 year’s share growth was +49.50 (42.04%), the last 5 year’s share growth was +121.44 (266.09%), and the maximum share growth was +160.30 (2,306.47%).

Tata Steel Share Price Return amount was last 1 month -8.78%, the last 3 months’ share return was 4.39%, the last 1-year share return was 42.61%, the last 3 years’ share growth was 30.68%, the last 5 year’s return growth was 250.47%. As a Steel and Iron production company, the company will grow more in the future the share will grow more. If anyone wants to invest in the share it will grow more in the future.

Tata Steel Share Price Target 2024

Tata Steel Company is now engaged in manufacturing and distributing steel products in the Indian and International markets. The company has a presence in iron ore and coal for manufacturing steel products. Some of the products of Tata Steel are cold rolled, BP sheets, Galvano, hot rolled pickled and oiled, high tensile steel strapping, full hard cold rolled, etc.

Under Tata Steel Company Some of the branches of production products are ‘Steel n Style’ which offers new designs and stylish furniture like almirahs, showcases, dressing tables, beds, and reading tables, ‘Tata Pravesh’ which provides steel doors & windows. The company also fixed the production of tube capacity of 4 Million tonnes by the year 2030, tinplate manufacturing capacity increase to 0.7 million tonnes by the year 2025, and Iron Pipes production capacity to 0.4 MTPA by the year 2024.

| Year | Tata Steel Share Price Target 2024 |

| 1st Price Target | 150 |

| 2nd Price Target | 290 |

The total revenue amount of the company was ₹131,523.63 Crore in March 2022 which became ₹133,456.89 Crore in March 2023. The net revenue from operation was ₹127,681.23 Crore in March 2022 which became ₹127,467.62 Crore. The current tax amount was ₹5123.09 Crore in the financial year 2023. If we look at the share price forecast of Tata Steel Share Price Target 2024, the 1st Price Target is ₹150 and the 2nd Price Target is ₹290.

Tata Steel Share Price Target 2025

Tata Steel Company is one of the world’s largest geographically diversified steel producers which has an annual capacity of 22.2 million tonnes steel production capacity. In the financial year 2023, March the group recorded the largest turnover of US$31 billion. In the year 2006, Tata Steel set up a deal with the Anglo-Dutch Company, Corus to buy a 100% stake at $8.1 billion.

Tata Steel company also manufactures a wide range of infrastructure equipment like frame-like sections, tubes, and building solutions (roof and wall products. Tata Steel Company also has an implementation in the Indian Automobile Sector for supplying raw materials such as micro-alloyed high-strength steels, Interstitial Free (IF) steel, and Galva Annealed for two-wheeler fuel tanks, etc.

| Year | Tata Steel Share Price Target 2025 |

| 1st Price Target | 310 |

| 2nd Price Target | 480 |

The Sales amount of the company also increased, in the last 5 years sales growth was 17.12% which became 29.12% in the last 3 years. The net sales amount was ₹34,899.59 Crore in the financial year 2022 which became ₹35,563.89 Crore. The company gives an important outlook on the R&D sector and in the last year invested ₹275 Crore for more development of products. If we look at the share price forecast of Tata Steel Share Price Target 2025 the 1st Price Target is ₹310 and the 2nd Price Target is ₹480.

Tata Steel Share Price Target 2027

Products primarily used in white goods, lighting, IT hardware, and office equipment. The products of Tata Steel Company an important role in providing international energy and power sector such as pipeline systems, structural products, light fabricated systems, and steel components for drilling and power generation. The company’s products also use the reengineering sector like the manufacturing of motors, gears, engines, etc. For the production purpose, the raw material cost was ₹92,078 Crore in the financial year 2022 and in the year 2023, the amount was ₹1,15,892 Crore.

| Year | Tata Steel Share Price Target 2027 |

| 1st Price Target | 800 |

| 2nd Price Target | 1120 |

The steel production capacity increased rapidly in the financial year 2023 quarter three result the production capacity was 4.77mn tons which increased to 4.82mn tones in the quarter four result in the year 2023. Tata Steel Company caters to 88% of the domestic market. The profit amount slowly increased in the last 5 years the profit growth was 30.56% which became 32.23% in the year last 3 years. The net profit amount was ₹18,078.98 Crore in the year March 2021, which became ₹34,023.18 Core in 2023, March. If we look at the share Price forecast of Tata Steel Share Price Target 2027 the 1st Price Target is ₹800 and the 2nd Price Target is ₹1120.

Also Read- SAIL Share Price Target

Tata Steel Share Price Target 2030

In the year 2023, Tata Steel Company’s flat steel production capacity was 16 MTPA per annum company fixed the target to increase by 27 MTPA per annum by the year 2030, In the year 2023, long steel production capacity was 5 MTPA per annum company fixed the target to increased 13 MTPA per annum by the year 2030, Crude steel production capacity 21 MTPA to 40 MTPA (from the year 2023 to 2030), tubes capacity from 1 MTPA to 4MTPA (from the year 2023 to 2030). By the year 2023, the company fulfill the target improvement of the Blast furnace in the Jamshedpur area.

| Year | Tata Steel Share Price Target 2030 |

| 1st Price Target | 1820 |

| 2nd Price Target | 2060 |

As the company spreads its business outside of the country FII investors in the company are high which is 20.21% which is a very progressive part of the company’s growth. The EBITDA amount was ₹4,256 Crore in the quarter three result in the year 2023 which became ₹7,236 Crore in the year 2023 quarter four result. The net debt amount of the company decreased ₹3900 Crore in the year 2023 the amount is ₹67,812 Crore.

The ROE amount of the company also increased in the last 5 years the ROE percentage was 18.56% which became 22.12% in the last 3 years. All the share price forecast depends upon the company’s overall performance, market favorable conditions, etc. If we look at the share price forecast for Tata Steel Share Price Target 2030 the 1st Price Target is ₹1820 and the 2nd Price Target is ₹2060.

How To Purchase Tata Steel Share?

The most common trading platform for purchasing the Tata Steel Share is described below.

- Zerodha

- Upstox

- Groww

- Angelone

Peer’s Company of Tata Steel Ltd Company

- Aanchal Ispat

- Adhunik Metalik

- Adishakti Loha

- Aditya Ispat

- Aerpace Ind

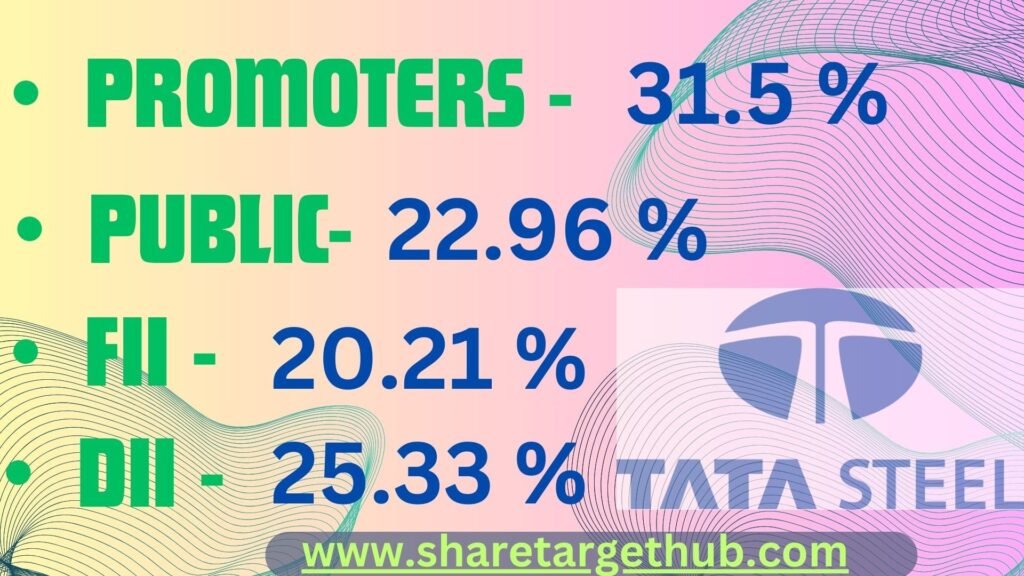

Investors Types And Ratio Of Tata Steel Ltd Company

There are mainly four Types of Investors in Tata Steel Company. The company’s growth also depended upon the ratio of investors who invested in the share.

Promoters Holding

Promoters Holding means how much capital is invested by company promoters (owner of the company) through overall capital. Tata Steel Company’s promoter holding capacity is 31.5%.

Public Holding

Public Investors an individuals who invest in the public market for profit in the future (large and small companies). Tata Steel Company’s public holding capacity is 22.96%.

FII (Foreign Institutional Investors)

Foreign Institutional Investors are those big companies that invest in different countries company. Tata Steel Company’s FII is 20.21%.

DII (Domestic Institutional Investors)

Domestic Institutional Investors (like Insurance, companies mutual funds) who invest in their own country. Tata Steel Company’s DII is 25.33%.

Advantages and Disadvantages Of Tata Steel Share

Every share has some advantages and some disadvantages also. So, the Tata Steel Share Price Target also has some advantages and disadvantages which are described below.

Advantages

- Last 3 years Profit growth was 32.23% which is a very positive side for the company’s growth.

- Last 3 years ROE growth was 22.12% which is a progressive part of the company.

- Last 3 years revenue growth of the company was 29.12%.

- The company has a good cash conversation cycle which is -52.23 days.

- The company has good cash flow management, PAT margin is 1.45.

Disadvantages

- Last 1 year’s profit amount decreased.

- Major fall in TTM Net Profit.

Also Read- Hindalco Share Price Target

FAQ

What is the Tata Steel Share Price Target for the year 2024?

Tata Steel Share Price Target for the year 2024 is ₹150 to ₹290.

What is the Tata Steel Share Price Target for the year 2025?

Tata Steel Share Price Target for the year 2025 is ₹310 to ₹480.

What is the Tata Steel Share Price Target for the year 2027?

Tata Steel Share Price Target for the year 2027 is ₹800 to ₹1190.

What is the Tata Steel Share Price Target for the year 2030?

Tata Steel Share Price Target for the year 2030 is ₹1820 to ₹2060.

What is the Tata Steel Share Price Target for the year 2035?

Tata Steel Share Price Target for the year 2035 is ₹3000 to ₹3240.

What is the Tata Steel Share Price Target for the year 2040?

Tata Steel Share Price Target for the year 2040 is ₹4010 to ₹4125.

What is the Tata Steel Share Price Target for the year 2028?

Tata Steel Share Price Target for the year 2028 is ₹1200 to ₹1340.

What is the Tata Steel Share Price Target for the year 2026?

Tata Steel Share Price Target for the year 2026 is ₹510 to ₹750.

Is Tata Steel Share good to buy?

Tata Steel Company has huge growth in profit amount and diversified product portfolio for this reason with the company’s growth the share will grow. The company’s last 3 year’s growth is 33.12% and the last 6 month’s share growth was 28.12%, if anyone wants to invest in the share it will be beneficial in the long-term process.

Who is the CEO of Tata Steel Company?

Mr. T V Narendran is the CEO of Tata Steel Company

Who Is the owner of Tata Steel Company?

Sir Dorabji Tata and Sir Ratan Tata are the owners of Tata Steel Company.

What is the future prediction of Tata Steel Company?

As Tata Steel company spreads its business outside of India the business will grow more in the future. The company has a diversified product portfolio and it is attached to different sectors. The production of steel became very essential for the human lifestyle. The revenue growth of the company for the last 3 years was 29.12% in the future it will grow more.

Conclusion

Hopefully, www.sharetargethub.com will help you gain some basic ideas about the Tata Steel Share Price Target. By doing the research and taking advice from expertise we ensure that on a long-term basis, Tata Steel Share Price Target may reach a very high position. Tata Steel Company is related to the manufacturing of the metal production sector. So the demand for this sector also increases which helps the share to gain profit in the future.

If you think this website will be helpful for you then you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.